Dear Colleagues!

Kindly find our weekly fintech and banking newsletter. If you do not want to receive it, you can unsubscribe from the mailing list at the bottom of the page.

Yours faithfully,

Finstar PR Department

Аsia

Fintech Firm Rapyd Introduces Multi-Currency Treasury Platform

The Paypers, Posted November 3, 2022

Rapyd, the fintech platform for global payments, payouts and business everywhere, has announced the launch of a multi-currency Treasury Solution, which is reportedly the “first of its kind” for the APAC area.

This solution is described as a collection of cash management features/solutions that optimize the cost and effort of international payments operations.

As mentioned in the announcement, Rapyd’s Treasury Solution allows companies engaged in cross-border trade to enhance their financial relationships. CFOs, treasurers and controllers are able to customize how they manage liquidity, balance currencies, and mitigate currency risk while also improving their treasury hub in Singapore.

#Payments

Singapore: DBS Tests FX Trading, Government Securities Using Blockchain

The Fintech Times, Posted November 3, 2022

DBS, a Singapore-based financial institution that operates across Asia, has announced that it has utilized permissioned DeFi liquidity pools on a public blockchain to test FX trading and government securities transactions.

According to DBS, the first industry pilot included JP Morgan, and SBI Digital Asset Holdings with a trade comprised of the outright purchase and sale of tokenized Singapore Government Securities (SGS), Singapore Dollar (SGD), Japanese Government Bonds, and Japanese Yen (JPY).

#Fintech

Indonesia Stock Exchange Signs MoU with Green Fintech MVGX

Crowdfund Insider, Posted November 1, 2022

Indonesia Stock Exchange (IDX), the country’s national securities exchange and among the “fastest growing” in the continent, is exploring the possibility of working with MetaVerse Green Exchange (MVGX), a digital green exchange licensed and regulated by the Monetary Authority of Singapore (MAS), “to develop Indonesia’s carbon exchange system.”

This development comes “amid the Indonesian government’s plan to launch the country’s own emissions trading scheme by 2025 to incentivize domestic businesses in high-emitting industries to reduce their emissions.”

To date, Indonesia is “among 61 countries with established carbon pricing regulations and has committed to reducing its greenhouse gas emissions by 43 percent by 2030 with international support, whether through financing or new technologies.”

#Payments

India’s Cashfree Payments Introduces Lending Solution to Help Financial Services Firms

Crowdfund Insider, Posted October 31, 2022

Cashfree Payments, India’s payments and API banking solutions company, has rolled out their Disbursement and Collections solution for Lending, “to enable NBFCs and their partner LSPs to comply with the new Digital Lending guidelines.”

Cashfree Payments will “facilitate both digital lending and co-lending use cases through their solution.”

The RBI has “prescribed that all fund-flows relating to loan disbursement and repayment must be directly between the bank account of the lender and borrower, without any pass-through or pool account of any third party.”

However, there are limited carve-outs “to this general rule for: (i) co-lending transactions entered into by banks and NBFCs in accordance with the existing regulatory instructions issued by the RBI; (ii) disbursements covered exclusively under the statutory or regulatory mandate of the RBI or any other regulator; and (iii) disbursements to third parties pursuant to specific end-uses of the loans.”

#Payments

India begins digital rupee pilot

Finextra, Posted November 1, 2022

The Reserve Bank of India has begun a wholesale digital rupee pilot, with a retail trial set to follow within weeks. The wholesale pilot will focus on “settlement of secondary market transactions in government securities,” says a statement.

The use of a CBDC is expected to make the interbank market more efficient, with settlement in central bank money cutting transaction costs by pre-empting the need for settlement guarantee infrastructure or for collateral to mitigate risk.

The RBI is pulling in nine banks – State Bank of India, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Yes Bank, IDFC First Bank and HSBC – for the pilot.

Other wholesale CBDC pilots, including for cross-border payments, will follow while a retail trial, involving merchants and customers, will launch within a month

#Payments

Europe

Swedish Fintech Payer, American Express to Support B2B Payments Across the Nordics

The Paypers, Posted October 31, 2022

Payer, the B2B technology company specializing in digital conversion, payments, and finance automation, with a mission to digitalize the B2B industry wherever payments play a central role, has announced that it will now facilitate American Express payments “across the Nordics in Denmark, Finland, Norway, and Sweden.”

This means that companies using Payer as a B2B digital payments platform “will now be able to accept American Express® Cards as a payment method for all purchases and services.”

Daniel Brännström, Director of Partnerships at Payer, stated:“Payer is excited to be partnering with American Express to provide our European B2B customers even greater payment choice when paying for goods and services on our B2B checkout, across a wide range of industries including manufacturing, automotive, consulting, and financial services. This aligns with our objective of being the preferred B2B Payments Service Provider across the Nordics and in Europe.”

#Fintech

Raisin migrates its UK platform to ClearBank

Fintech Futures, Posted November 1, 2022

Fintech company Raisin has migrated its UK platform to embedded banking partner ClearBank.

ClearBank will power Raisin UK’s FSCS-protected account offering for customers to manage money that they wish to deposit in savings products offered by Raisin’s partner banks.

The partnership will give Raisin customers access to faster payments and other services via ClearBank’s embedded banking platform, and they will also benefit from Confirmation of Payee checks when transferring funds, providing an additional layer of security. The two firms say they will also work to improve the functionality of existing products, including responsiveness, reporting and speed of funding of selected savings accounts in a bid to boost operational efficiencies

#Paytech

Wise lands £300m debt facility to fuel growth plans

Fintech Futures, Posted October 27, 2022

Global money transfer firm Wise has secured £300 million in debt financing to support its future growth plans.

The syndicated debt facility was arranged and led by Silicon Valley Bank UK with six other banks also participating.

Wise, originally TransferWise, was launched in 2011 to allow people and businesses to move money across borders. Currently, it allows individuals and business customers, including banks and large companies, to hold over 50 currencies, move money between countries and spend money abroad.

Matt Briers, chief financial officer at Wise, says the new facility led by Silicon Valley Bank UK “will offer us flexible and efficient access to working capital” as it looks to invest in the development and improvement of its payments services.

Thomas Easterby, managing director of corporate finance at Silicon Valley Bank UK, says the move “continues our long-term relationship with Wise following the pre-IPO syndicated facility last year”.

#Payments

1inch Teams Up with Neobank Revolut to Launch Crypto Learn and Earn Course

Crowdfund Insider, Posted November 1, 2022

The ‘Learn & Earn’ course launched with Revolut will “broaden newcomers’ understanding of DeFi and help to shape their decentralized future experience in an easy, fun and efficient way.”

Aiming to empower more people with DeFi knowledge, the 1inch Network is happy to announce “the launch of the crypto ‘Learn & Earn’ course as part of Revolut’s education program run with various partners.”

This is “the first step of the partnership with the leading customer-centric platform, which offers all the necessary tools for money management.”

Revolut, the global financial superapp with more than 20 million customers worldwide, expands its list of cryptocurrencies offered “to customers and diversifies its educational resource ‘Learn & Earn’, which has been completed by approximately 2.6 million crypto enthusiasts since its launch in March 2022.”

#Fintech

UK’s Molo Finance Teams Up with Brilliant Solutions

Crowdfund Insider, Posted November 1, 2022

Molo Finance has partnered with Brilliant Solutions, a distributor of mortgages that sits between mortgage brokers and lenders.

This partnership “further underlines Molo’s ambitions to offer fully-digital mortgages on a larger scale and it will provide Brilliant Solutions’ membership of directly authorized (DA) brokers with access to Molo’s extensive specialised buy-to-let product range.”

Molo are “offering products for Investor Led, Holiday Let, and New Builds, in addition to previous products like HMO and Portfolio Landlords being updated on Fixed, Variable and Tracker rates.”

Providing landlords more investment choices, “with the goal to support them through the current challenging market environment.”

#BNPL

USA

Digital Commerce: Karta.io Joins Visa’s Fintech Fast Track Program

Finextra, Posted November 1, 2022

U.S. startup Karta.io, the financial OS for e-commerce teams, announced that it joined Visa’s Fintech Fast Track Program.

Through the program, Karta.io will “have access to the tools and resources needed to scale its business using the reach, capabilities, and security that VisaNet, Visa’s global payment network, offers.”

Through Visa’s Fintech Fast Track Program, Karta.io is now “able to build and expand new spend management experiences for business and build a financial ecosystem for managing company cash flows with advanced tools for organizing expenses and control over business finances.”

#StartUp

Fintech Firm Veritran Launches Small Business Solution for Financial Institutions

Crowdfund Insider, Posted November 1, 2022

Veritran, a global financial technology solutions provider, launched Fusion by Veritran, a Small Business Solution for the United States market at Money 20/20 in Las Vegas.

The flagship solution of the tech company is “designed for freelancers, independent professionals and owners of small businesses, allowing them to better handle their personal and business finances all in one comprehensive solution.”

Fusion by Veritran is “offered in multiple digital channels, allowing users to access via mobile devices, notebooks, desktop PCs and laptops.” The first wallet that allows customers to handle their personal and business “lives in one single app.”

#Mastercard

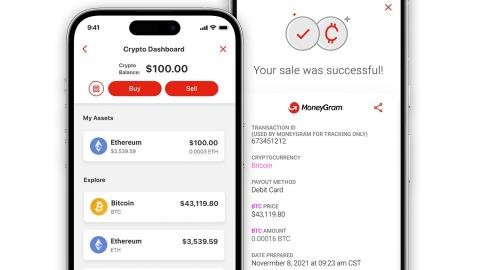

MoneyGram lets US customers buy and sell crypto

Finextra, Posted November 2, 2022

MoneyGram users in the US can now buy, sell and hold cryptocurrency via the money transfer firm’s mobile app.

Available to customers in nearly all US states for Bitcoin, Ethereum and Litecoin, MoneyGram plans to expand the service to more markets and more coins.

The feature is the fruit of MoneyGram’s partnership with Coinme, a US crypto outfit in which MoneyGram invested early this year. The partners already work together to let people buy and sell bitcoin at some MoneyGram locations.

MoneyGram has been aggressively pursuing crypto opportunities to ensure it does not get let behind in the blockchain era. The firm teamed up with Ripple back in 2019, tapping the blockchain startup’s XRP digital currency for cross-border payment and foreign exchange settlement.

#Fintech

OCC sets up fintech office

Finextra, Posted October 28, 2022

US regulator the Office of the Comptroller of the Currency (OCC) is setting up a financial technology unit to help it keep up with the “rapidly changing banking landscape”.

Arriving early next year, the Office of Financial Technology will build on and incorporate the Office of Innovation, which the OCC established in 2016 to coordinate agency efforts to support “responsible financial innovation”.

The new office will be led by an as yet unnamed chief financial technology officer, who will be a deputy comptroller reporting to the senior deputy comptroller for bank supervision policy.

Acting Comptroller of the Currency Michael Hsu says: “Financial technology is changing rapidly and bank-fintech partnerships are likely to continue growing in number and complexity.

“To ensure that the federal banking system is safe, sound, and fair today and well into the future, we need to have a deep understanding of financial technology and the financial technology landscape.”

#Fintech

LatAm

Sterling Trading Tech Selected by Avenue Securities to Bring Brazilian Investors Access to US Markets

Crowdfund Insider, Posted October 31, 2022

Sterling Trading Tech (STT), a provider of order management systems, risk and margin tools and trading platforms to the capital markets worldwide, today announced it has signed with Avenue Securities, a U.S. digital brokerage serving retail investors in Brazil, “to provide its suite of technology solutions to offer Brazilian investors sophisticated trading tools and functionality to trade the U.S. markets.”

Founded in 2018 and based in Miami, Avenue claims it is “the leader in Brazilian investments abroad. Avenue is an online brokerage that provides easy access for Brazilian retail investors interested in securities traded on U.S. exchanges.” The firm claims it is “the largest broker-dealer in the U.S. for Brazilians, currently serving more than 600,000 Brazilian investors who have discovered the opportunities of the American financial markets through Avenue.”

#Fintech

Thank You for reading us!

Finstar PR Department