Аsia

BNPL: Vietnam’s Fundiin Secures $5M via Series A Round

Crowdfund Insider, Posted October 24, 2022

BNPL Fintech firm Fundiin has secured $5 million in capital via a Series A round that was recently co-led by Trihill Capital and ThinkZone Ventures.

The funds from the investment round should assist Fundiin with expanding at a quicker pace and enter Indonesian markets in the foreseeable future.

With the capital injection, Fundiin can enhance its presence in Vietnam. The Asian Fintech firm will also aim to contribute to creating new products and attracting new talent before expanding further to Indonesia.

Nguyen Anh Cuong, CEO and co-founder of Fundiin, noted that the credit card penetration rate in Vietnam was mere 5%. That’s why there is a potential market for BNPL or Buy Now Pay Later products to further develop. He also mentioned that BNPL was a key solution to support financial inclusion and prevent abuse from predatory loan sharks.

#BNPL

CBDCs: JCB, IDEMIA, Soft Space Launch “JCBDC” Pilot to Test CBDC In-Store Payments

Crowdfund Insider, Posted October 25, 2022

Japan’s “only” international payment brand JCB Co., Ltd. has launched “JCBDC” (JCB Digital Currency) pilot project with identity technologies no. 1 IDEMIA and Fintech company Soft Space Sdn. Bhd.

JCBDC pilot will “develop a CBDC (Central Bank Digital Currency) payment solution and conduct a pilot test with Tokyo merchants.”

Over the past few years, central banks in many countries and regions “have been testing CBDCs that should soon be widely accepted by consumers and merchants.”

However, merchants might be “reluctant to accept them, and mass-market rollout may be held up by people without smartphones, like children and the elderly, who could find the user interfaces and payment systems hugely challenging.”

#Fintech

India’s Cashfree Payments Launches ‘Issuance’ to Enable Fintechs to Introduce Prepaid Cards

Crowdfund Insider, Posted October 23, 2022

Cashfree Payments, which claims to be one of India’s leading payments and API banking solutions companies, announced the launch of Card Issuance Stack with their new solution ‘Issuance’ “to enable businesses such as fintechs and platforms to launch prepaid cards and wallets for their customers, employees and partners.”

‘Issuance’ is “a prepaid card and wallet issuance API stack which can be used for payroll & incentive disbursals, customer loyalty programs, expense management among other use cases. ‘Issuance’ allows businesses to launch both physical and virtual prepaid cards.”

‘Issuance’ will “offer low-code and no-code flows to enable businesses to launch their customized prepaid card or wallet in a few weeks without deep integration with multiple entities.”

#Payments

Singapore lays down the law for crypto trading and stablecoins

Finextra, Posted October 26, 2022

The Monetary Authority of Singapore (MAS) has published two consultation papers proposing strict regulatory measures to reduce the risk to consumers from cryptocurrency trading while supporting the development of stablecoins as a credible medium of exchange. The Singapore central bank contends that trading in cryptocurrencies is highly risky and not suitable for the general public. However, it acknowledges that cryptocurrencies play a supporting role in the broader digital asset ecosystem, and it would not be feasible to ban them.

Instead it is proposing stringent new requirements on providers of Digital Payment Token (DPT) services deisgned to discourage casual use of cryptocurrency trading by consumers. These include mandatory testing of customers to guage prior knowledge of crypto risks; a ban on retail users from borrowing or accepting credit card payments to purchase crypto; and the prohibition of crypto-related incentives, such as free tokens, gifts, or celebrity endorsements

#Fintech

Europe

Big Tech in Fintech: UK FCA to Review Large Tech Firms Providing Financial Services & Competition Concerns

Crowdfund Insider, Posted October 25, 2022

The UK Financial Conduct Authority (FCA) is commencing a review of “Big Tech” providing financial services.

The FCA will be reviewing firms like Google, Amazon, Apple, Facebook, and others that have emerged as top financial services providers in sectors like digital wallets and payments. The UK has long been a hotbed of innovation in financial services, and large tech firms have emerged as top providers partnering with UK Fintechs as well as challenging Fintechs in certain segments.

Sheldon Mills, the Executive Director of Consumers and Competition at the FCA, commented on the initiative:

“In recent years, Big Tech’s entry into financial services, in the UK and elsewhere, has demonstrated their potential to disrupt established markets, drive innovation and reduce costs for consumers. Across the world, we’ve seen the capability of Big Tech to offer transformative new products in areas such as payments, deposits and consumer credit. We want to make sure that these benefits are fully realised while, at the same time, ensuring good consumer and market outcomes. This is vital when we consider the role of Big Tech firms in the provision of key technological infrastructure like cloud services. The discussion we are starting today will inform the FCA’s pro-competitive approach to digital markets, and I encourage consumers, firms and fellow regulators to join the conversation.”

#Fintech

How the rise of PayTech is reshaping the payments landscape

EY, Posted October 21, 2022

The disruption of the traditional payments ecosystem has been rapid and impactful. FinTechs have grasped an opportunity to leverage their technological capabilities and customer centricity to expand into payments.

In the midst of this disruption, a whole new subsection of digital players has emerged: PayTechs. PayTechs make up 25% of FinTechs and are focused on the payments value chain, as well as payments facilitators (PayFacs), PSPs, networks creating new payments propositions, and payments technology suppliers.

Payments lie at the intersection of commerce and the digital economy, with a market size of US$240 tn.1 Valued at over 2.17tn, PayTechs have exploded into the market, recognizing that fast, frictionless and embedded payments offer a distinct competitive advantage. As the digital economy grows and customer appetite for seamless payments increases, PayTechs are offering integrated solutions for both consumers and merchants to meet this demand.

#Paytech

APImetrics, tomato pay, Finextra report finds neobank API call quality outperforms traditional banks

Finextra, Posted October 26, 2022

APImetrics, Finextra and tomato pay have released a report capturing the performance of UK open banking providers over the period July 2021 to July 2022, analysing over 17 million functional API calls.

David O’Neill, CEO, APImetrics said that while they “expected there to be differences between the different providers, we didn’t expect to see such a stark difference between the neobanks, CMA9 and traditional banks. The interesting thing for us, especially given that the infrastructure to deliver open banking is new for all providers, is such a difference in performance between each group. We had expected that they’d be closer together.”

The report highlights that API quality, especially the quality of the consent journey is a key factor in the health of APIs operationally. Maintaining a consistent performance is essential to the operation of a healthy ecosystem and the findings of the APImetrics, Finextra and tomato pay report shows there is still work to be done to achieve success in this area.

#Payments

Wise set to bring investing product to Europe

Finextra, Posted October 26, 2022

Wise is planning to launch its Assets investing service across Europe after securing a license in Estonia.

Currently only available in the UK, Assets lets users hold cash in their multi-currency accounts in different asset classes, while being able to spend and save as normal.

The Estonian Financial Supervision and Resolution Authority has given the green light for Assets to launch in the country. Wise also intends to apply for permission to passport the new licence and bring Assets to more European markets.

Lars Trunin, head of product, Wise, says: “We’re thrilled to be granted our new licence here in Estonia, which will allow us to take a big step forward in replacing traditional international banking with a faster, cheaper and more convenient system, initially for our customers in Estonia and eventually for people across Europe.”

#Fintech

BNPL firm Tymit raises £23m

Finextra, Posted October 26, 2022

London-based BNPL player Tymit has closed a £23 million Series A funding round led by retailer Frasers Group.

The money will be used for product development and support the launch of Tymit’s B2B2C instalment programme for merchants.

This, says the firm, provides all the benefits of BNPL under merchants’ own brand for free, with the ability to strengthen customer relationships through data-driven insights and loyalty.

The company will also continue to invest in its consumer proposition which is already live with over 40,000 active users and in the last 12 months processed £75 million in transactions.

Martin Magnone, CEO, Tymit, says: “We’re proud to provide merchants and partners with the instalment programme experiences that will help them get closer to their customers without taking a bite out of the basket or squeezing out their brand.”

#BNPL

Zip launches BNPL card

Finextra, Posted October 26, 2022

BNPL firm Zip has partnered WebBank to launch a physical card as it bids to make inroads into in-store shopping.

The Zip Card extends the company’s ‘Pay-in-4’ functionality offline, enabling instalments payments wherever Visa is accepted.

In a pilot programme, 90% of participants said the card makes in-store shopping easier – and interest is high, with Zip claiming to have built a 250,000-strong waitlist.

Jinal Shah, CMO, Zip US, says: “With the Zip Card, we are offering customers access to another fair, transparent payment method in a familiar format to use in-store, specifically at stores that do not accept contactless or mobile phone payments.”

#BNPL

UK’s IoD sets up fintech group

Finextra, Posted October 21, 2022

The UK’s Institute of Directors has launched a special interest group designed to boost the UK’s fintech sector

The IoD Finance and FinTech Group was launched at the institute’s headquarters in London where its City of London chair John McLean hailed the country’s fintech sector as “world class”.

While fintech generates roughly 80,000 jobs in the UK, its financial contribution to the national economy has wavered of late.

A report from KPMG published in September showed that investment in UK fintechs fell to $9.6 billion in the first half of 2022, down from $27.8 billion in the same period the previous year. While this decline is partly a result of a global economic slowdown, the UK’s figures are considerably worse than the global statistics where global investment in fintech fell from $111.2 billion across 3,372 deals in H1 2022 to $107.8 billion across 2,980 deals in H1 2021.

#BNPL

USA

Citi invests in white-label shopping rewards platform Wildfire

Finextra, Posted October 27, 2022

Citi Ventures has made a strategic investment in white-label reward programme platform Wildfire Systems.

Wildfire’s white-label, turnkey offering enables partners — which include financial institutions, telecoms, and technology companies — to provide their customers with cashback rewards, digital coupons and other benefits when they shop at thousands of online merchants.

The firm recently scored a major deal with Visa to power the card giant’s new Visa Affiliate Marketing Solutions programme.

“Wildfire is a leading player at the intersection of embedded finance, e-commerce, rewards, and loyalty,” says Luis Valdich, MD, head of fintech investing, Citi Ventures.

#Payments

CleverCards Announces Digital Mastercards in Europe

Crowdfund Insider, Posted October 25, 2022

Payments Fintech CleverCards has announced that it has integrated with Mastercard Processing Europe, as part of its recent partnership with Mastercard. This now allows digital Mastercards to be downloaded from the CleverCards platform.

Ireland-based CleverCards explains that this card integration now enables payment administrators in Businesses and Public sector organizations to custom brand their own Mastercards and personally configure each Mastercard for various uses.

Marcin Cichocki, Product co-founder and Senior Vice President at Mastercard Processing, said that launching payment applications has never been so fast and simple: “With a rapidly growing global transition towards more digital economies across 31 European markets, having Mastercard processing inside the CleverCards platform will significantly reduce the lead times and complexity for Financial Institutions, Public Sector organizations and Businesses that sit on legacy payment infrastructures. We continue to be impressed by the CleverCards digital-first value propositions and customer-centric approach and this payment processing capability will have a remarkable effect on the businesses and organizations that choose to glean its benefits.”

#Mastercard

Money20/20 US: JP Morgan adds Meta Pay checkout option

Finextra, Posted October 25, 2022

JP Morgan today announced that all merchants within their payments network will now have the option to enable Meta Pay for their customers.

A Meta spokesperson stated that the partnership is valuable for their overarching payments an financial services objectives as the bank offers a sizeable network of merchants, “including may beloved brands. Through this expansion, many more people will be able to use Meta Pay to seamless shop on the websites they love.”

Additional benefits for businesses include:

Easy setup: Minimal integration required from businesses, as Meta Pay integrates with their payments platform.

Secure: Payment card numbers are encrypted for safe and secure storage. The choice of a PIN, fingerprint or face ID to authenticate a payment adds extra security. For transactions made with Meta Pay, payment confirmation will be sent in an email.

Fast checkout: No login required if a customer is signed into Facebook or Instagram. Customers speed through checkout with pre-filled details.

No cost: No additional cost to businesses.

#Fintech

WeTravel raises $27m in Series B funding to boost fintech product development

Fintech Futures, Posted October 26, 2022

US-based SaaS platform WeTravel, which offers business travel management and payment services, has raised $27 million in a Series B funding round led by Left Lane Capital.

The round also saw participation from existing investors Base10 Partners and Swift Ventures, along with several angel investors.

With the new cash influx, WeTravel plans to accelerate the development of its travel-specific fintech solutions on both the front-end for customers and back-end for businesses, in order to meet demand. It also intends to grow its team to help boost product development.

WeTravel was formed in 2016 to help travel businesses digitise their travel booking processes, offering integrated payment solutions and a peer-to-peer (P2P) payment network allowing businesses to control money movement, refunds, disputes and traveller transactions, charging 1% in transaction fees.

#Fintech

US fintech start-up Banyan lands $43m Series A

Fintech Futures, Posted October 24, 2022

Banyan, a Stock Keeping Unit (SKU) data network for businesses, has landed a $43 million Series A round led by Fin Capital and M13.

The round consists of $28 million in equity and $15 million in venture debt, with the firm’s total funding raised to date now standing at $53 million.

FIS Impact Ventures, Bridge Bank (a division of Western Alliance Bank), Interplay and TTV Capital also participated in the round.

Additional investors include More Than Capital, Manifold, Motivate Venture Capital, Elizabeth Street Ventures and Gaingels along with angel investors Jonathan Weiner, David Chubak and Kush Saxena. The fintech has also added former Walmart and American Express executive Janey Whiteside to its board.

#StartUp

LatAm

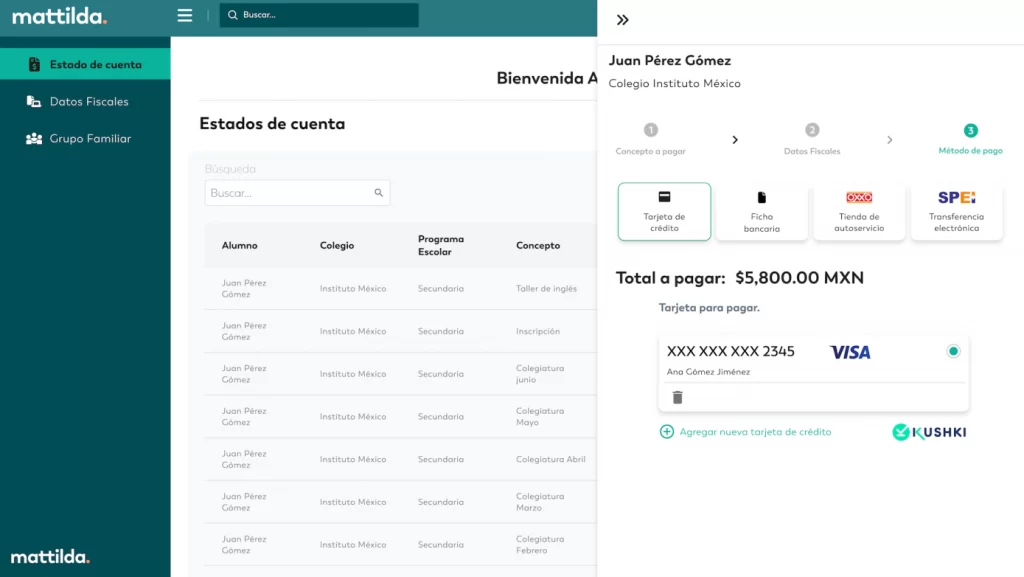

Mattilda wants to take over payment collection for Latin America’s private schools

TechCrunch, Posted October 27, 2022

Digital payments are gaining momentum in Latin America, and startups like Mexico-based mattilda are putting their spin on streamlining financial and administrative processes for private schools while also offering credit backed by future school fees.

The company was founded in 2022 by José Agote, Jesús Lanza, Juan Pablo Bravo, Adrián Garza and Ileana Gómez. Agote, Lanza and Bravo all previously worked together at Lottus Education, a university-focused educational platform in Mexico.

It’s forecasted that cashless payments in Latin America will double by 2030. Debit cards are used a majority of the time, with cash a close second, according to reports. Most schools accept bank transfers and debit card payments, but are not set up for those to be made other than by driving over to the school with a card in hand. Schools also do not have an easy way to see who was still missing payments, CEO Agote said.

#Fintech

New Rapyd Research Highlights Latin America as a Global Leader in Payments and Fintech Innovation Noting Speed and Security as Top Disbursement Priorities for Workers and Consumers

Business Wire, Posted October 25, 2022

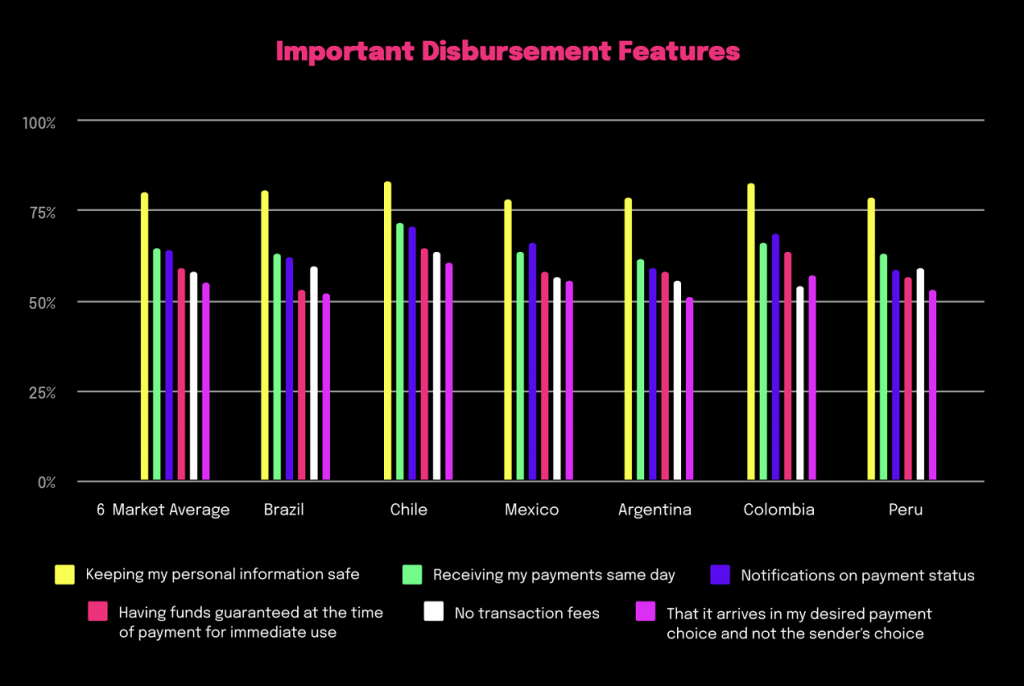

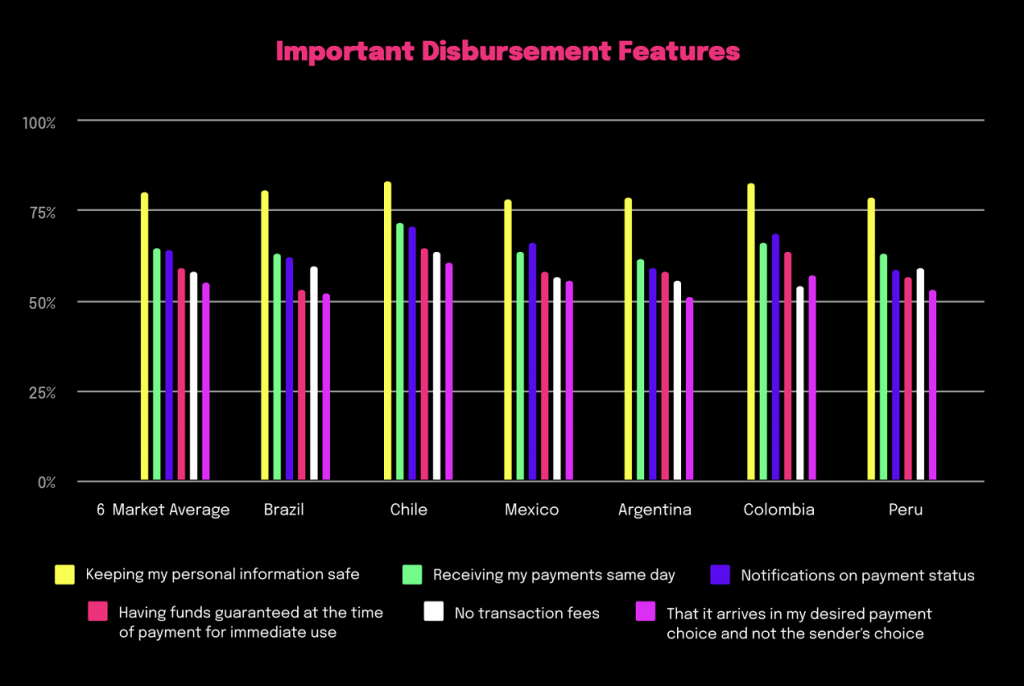

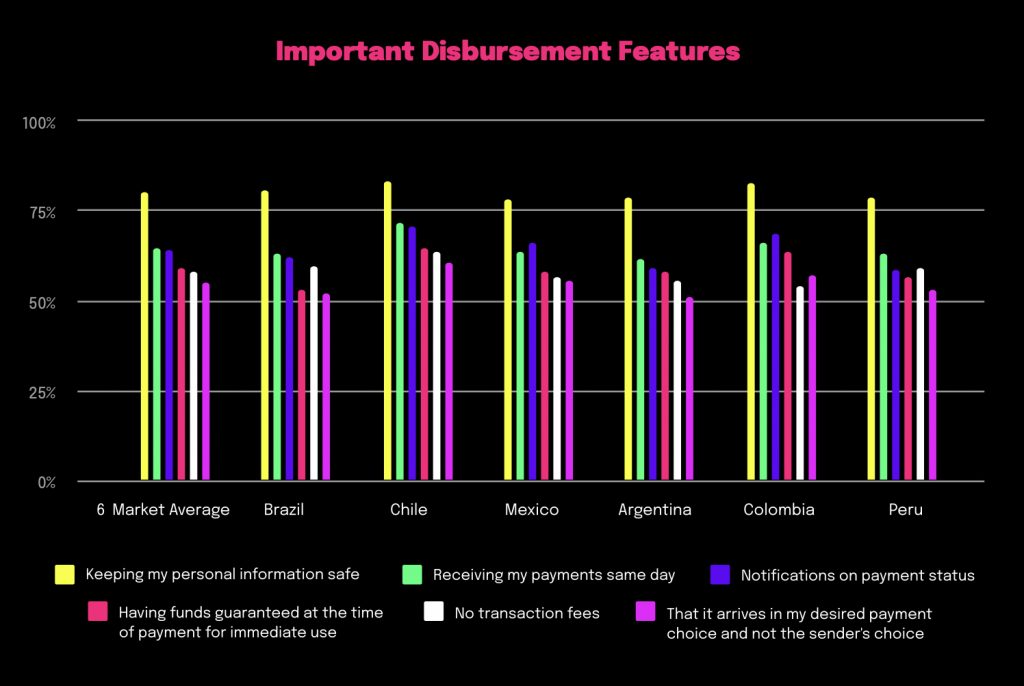

Rapyd, the leading fintech-as-a-service partner, today released its 2022 Latin America State of Disbursements Report. The report analyzes the findings of a survey Rapyd conducted in June 2022 to more than 3,000 online consumers in Argentina, Brazil, Chile, Colombia, Mexico and Peru on their most-commonly used and preferred ways to get paid. The findings illustrate that with the region’s hypergrowth in local and cross-border business, LATAM is emerging as a primary market for expansion by global businesses. Contractors, workers and suppliers are seeking quick and secure payouts and disbursements in their preferred method across multiple countries. The report shows that:

Traditionally underserved by banks, LATAM beneficiaries have adopted an open mind to fintech and are showing a clear preference to digital methods to receive payments:

LATAM consumers want to receive direct digital payments. Over 50% of respondents prefer to receive their earnings by direct bank transfer.

Direct bank transfers are also preferred for other payouts such as rental income, tax refunds, loan payouts and commissions. Ewallets and wire transfer are another preferred way to receive payments for personal gifts, repayments, commissions and many other payouts.

Even as these various digital payments soar, cash is still one of the most common ways to receive payments. Over 20% have received payment via cash for various payouts in the past three months.

Nearly 40% of consumers receive payments regularly for freelance and gig work. Many of these gig workers may not have access to traditional bank accounts and are more open to getting paid by direct, same-day digital payments through ewallets or other methods.

#Digital banking