By Eugene Timko, Investment Director of Finstar Financial Group

Financial technology, or fintech for short, is a term used when referring to companies that are introducing cutting edge technology into the financial services industry. According to some estimates, there are around 10,000 fintech startups and growing. Between 2010 and 2015, the volume of venture capital investment in fintech grew tenfold, to almost $20bn a year, and dozens of startups managed to raise more than a billion dollars. However, despite all of this, the penetration of new digital business models in the financial sector in the USA is less than 1%. So, what is the fintech industry and into which market segments are investors’ putting their funds?

- Lending

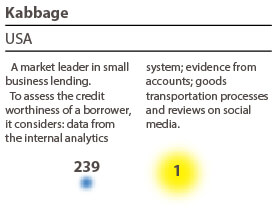

This is the simplest consumer market segment, where around 60% of profits in modern banking are generated and where half of fintech venture capital investment goes. The sector started to develop after the 2008 financial crisis, when regulatory changes made lending to certain groups of borrowers less profitable. The first big sector success stories involved companies that were not competing directly with banks, but who were aiming for customers that were not targeted by banks (approximately 2 billion people globally have no access to banking services). One of the most striking examples was microfinancing organisation Wonga, in Great Britain, which focuses on high interest payday loans. By 2012 it was generating $100 million net profit in a fintech market that was still dominated by startups who were struggling to generate profits. Great progress has also been made when it comes to offering small business loans by fintech companies, this is a space that has been deemed as the highest risk by traditional banks.

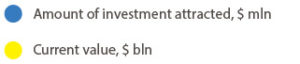

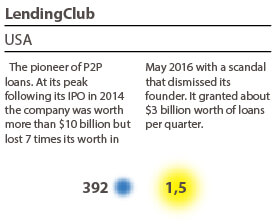

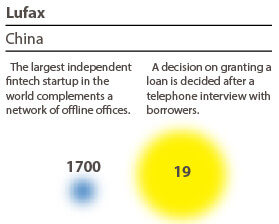

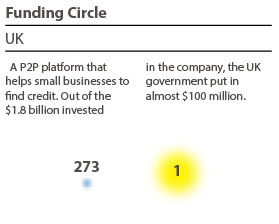

Startups working in the peer-to-peer (P2P) loans space, whereby providers offer a platform that links borrowers with lenders that essentially serve as retail investors, has also seen some success. This model has been successfully applied to business loans. The largest player in this area is British platform Funding Circle, which promises investors returns of more than 7% every year whilst interest rates in Europe are rarely more than 2%.

However, the P2P segment has also seen some of the biggest scandals in the history of fintech, namely the fall of the pyramid scheme Ezubao, operating in China. The scheme forged 95% of loan applications, and around a million Chinese investors lost $7.6 billion. The P2P lending boom in China is unique and the country currently has around 4,000 P2P platforms.

- Payments and transfers

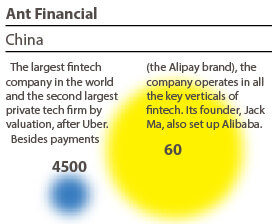

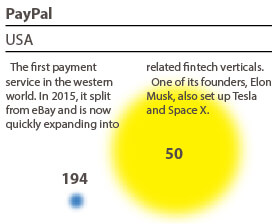

In this market segment, providers offer digital wallets, transfer payment services, online payment gateways, etc. This sector accounts for a third of all investments in fintech and major fintech companies have been created to offer payment services on a national scale (Qiwi in Russia is no exception). Yet the margins in this segment are rarely more than 2-3% and to generate serious returns providers need the scale of payment companies like PayPal and Ant Financial (the brand Alipay), who conducted transactions amounting to a combined $100 billion this month. Both players owe their scale to close associations with the largest goods platforms in the world eBay and Alibaba.

The money transfer subsector is another segment that is attracting investor attention, to the tune of more than $500 billion a year, due to opportunities created by inefficiencies in the traditional international money transfer processes, where the cost of international transfers can in some cases reach 10% or more).

- Asset management and investment

The asset management industry is currently hampered by access to a limited number of clients, which consists of professional investors, high net worth individuals or professional financial consultancies. Technological advancements are increasing the automation of the asset management process to deliver cost efficiencies. One such example is “Robo-advisers”, a class of advisor that uses algorithms to select portfolios and offer structural investment opportunities to clients that correspond with their specific investment preferences and risk profile. This Robo-adviser process is able to reduce annual payments for services to 0.3-0.5%, when accepted industry rates range from 1-2%. Fintech startups that operate in this space thrive in the lowering of costs and democratisation of access.

There are also numerous crowdsourcing platforms related to the asset management sector. Many people have become accustomed to investing in projects on sites like Indiegogo or Kickstarter (crowdfunding), and this manner of investing in companies’ share capital is gaining momentum.

- Digital banking and personal finances

In the fintech world, customer current accounts are considered to be the Holy Grail, because they provide a platform for on-going interaction with customers. However, on their own, current accounts are not monetized very well and are only sustainable when offered in relation to other products including payments, loans and investments. This is how most modern banks function. The so-called ‘neobanks’ are a new generation of digital banks. The first attempts at the creation of a digital bank were focused around creating convenient services based on existing banking infrastructure (e.g. Rocketbank in Russia), whereas new startups are creating infrastructure from scratch.

The flexibility of regulators’ attitude to digital banks has also helped startups to become full banks. In Great Britain, following changes to the banking legislation in 2014-2015, five new banks received licenses, and London subsequently became the de-facto capital of the fintech world.

Another important category of startups assists consumers to manage their personal finances. For example, the American company Credit Karma allows users to receive free access to their credit rating and credit history (previously this service cost up to $100), while also keeping a record of all financial products used by clients.

- Insurance

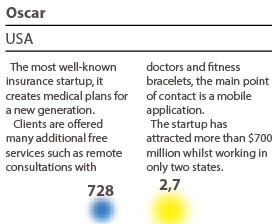

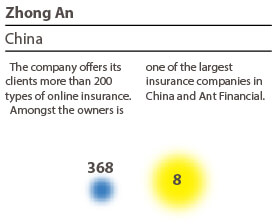

The insurance industry, which is worth around $5 trillion, has been slower to adopt fintech. Firstly, this is due to the industry’s strict regulatory requirements and lack of growth in the industry (when you look at the growth dynamics of the largest US insurance companies, as an example, over the past 100 years). The main area of innovation in the insurance industry sphere has taken place in the distribution sector, which is unsurprising given that the majority of insurance companies distribute their products largely through an offline network of agents, who take up to 20% in commission in the process.

Recently a trend has emerged whereby digital insurers have been established from scratch. The cost of launching such projects is major, for example American startup Bright Health, which is scheduled to launch in 2017, has already attracted more than $80 million to create an insurance company for the new generation.

- Infrastructure and emergency services

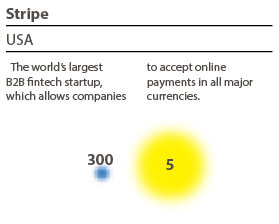

Fintech businesses in this category consist mainly of B2B startups offering their technology to other fintech players, banks or insurance companies. They offer point solutions, related to security, working with big data, credit scoring mechanisms as well as complete platforms and infrastructure for P2P loans or mobile payments providers.

As we have surveyed, fintech includes a large number of varied business models and approaches. Some of them, such as payments, exist at quite an advanced level whilst others are in their infancy. Financial organisations, despite their perceived unwieldiness are already actively examining their fintech offerings, understanding that new technologies in conjunction with their experience, accumulated customer base, capabilities to offer cheap borrowing in the context of an elaborate regulatory framework can lay the foundation for a digital financial institution for a new generation.

Telecom operators have also demonstrated their interest in fintech, through their involvement in the key data transfer process, and they are subsequently looking to generate income by providing client services. Of course, there are very active companies in the space, including: Google, Facebook and Apple. But it is still relatively easy for fintech startups to find a niche. However, the larger they become, the more they compete with traditional financial companies. It is only a matter of time before Fintech startups become more closely entwined with major offline players. We may refer to this new stage in the development of the industry – fintech 2.0.