Dear Colleagues!

Kindly find our weekly fintech and banking newsletter. If you do not want to receive it, you can unsubscribe from the mailing list at the bottom of the page.

Yours faithfully,

Finstar PR Department

Аsia

GoTo Financial partners with Bank Jago

The Paypers, Posted October 23, 2023

GoTo Financial has partnered with Indonesia-based Bank Jago to launch GoPay Tabungan by Jago, a bank account for daily transactions.

GoPay Tabungan by Jago can be accessed directly via the GoPay and Gojek apps, combining the simplicity of the former’s e-money services with the benefits of banking. The solution aims to enable Indonesians to access fintech and banking services in a single application.

The app was developed to offer users convenience and simplicity of use, with customers being able to upgrade their accounts to GoPay Tabungan by Jago in two minutes via the GoPay or Gojek apps. Moreover, users can top up their balance through several channels and complete payments at all merchants that accept GoPay, including payments on the Gojek and Tokopedia applications, and QRIS payments, as well as offline and online merchants. The app eliminates administrative fees, with users being able to complete free transfers via the GoPay app.

#Fintech

Singapore’s YouTrip eyes international expansion following $50m Series B raise

Fintech Futures, Posted October 27, 2023

Singapore-based fintech YouTrip, which offers a multi-currency mobile wallet, has secured $50 million in a Series B funding round led by Lightspeed.

The latest funding round follows YouTrip’s $30 million Series A in December 2021 and brings its total funding to date to over $100 million.

Launched in 2018, YouTrip holds a remittance licence issued by the Monetary Authority of Singapore (MAS) and teamed up with Kasikorn Bank to launch its services in Thailand in 2019. It offers foreign currency digital payment solutions for both consumers and businesses and also provides corporate cards for SMEs through its spend management platform YouBiz, launched over a year ago.

With the latest investment, YouTrip says it is “well-positioned” to accelerate its expansion plans across Southeast Asia, including countries such as Indonesia, Vietnam, the Philippines and Malaysia. Additionally, in the coming months, the fintech also aims to add new features and products to its wallet and invest further in its technology.

#Fintech

Razorpay expands its footprint in Malaysia

The Paypers, Posted October 27, 2023

India-based fintech company Razorpay has expanded in Malaysia by obtaining a licence to acquire merchants through Curlec, the new non-bank member of PayNet.

Following this announcement, Curlec by Razorpay was made a non-bank member of the national payments network and infrastructure, Payment Network Malaysia Sdn Bhd (PayNet).

This membership is set to allow Curlec to drive nationwide adoption of real-time payments through DuitNow, the Malaysian payment solution that was designed to enable real-time payments between locally registered bank accounts. The product also gives users the capability to transfer and receive funds instantly by using their mobile device and their national identification number, without the need for a bank account number.

The Curlec by Razorpay will be leveraged in order to build a safe, customer-first, and efficient payment infrastructure for clients and individuals in Malaysia. In addition, Curlec aims to accelerate the process of developing a cashless society in the region.

#Fintech

Europe

UK’s Digital Bank Monzo Is Reportedly Holding Talks to Sell £300M Stake

Crowdfund insider, Posted October 27, 2023

Uk’s digital bank Monzo is reportedly holding discussions in order to potentially sell a new £300 million stake.

As first reported by Sky News, the share sale, which may value Monzo at over £3.5 billion, is probably the final such transaction before it goes after a stock market flotation.

At present, Monzo is in talks regarding a £300M+ fundraising deal that may result in the business becoming the most highly-valued virtual bank in the UK.

Sky News also revealed that Monzo, which was established back in 2015 and currently claims 8.5 million customers, is in extensive talks with various blue-chip investment funds regarding a share sale set to value the firm at £3.5B+.

The discussions are not yet finalized, and the identity of new backers has not been confirmed by the firm’s board, sources familiar with the matter revealed on Thursday.

#Digital bank

UK’s Digital Bank Tandem Takes a Fintech “Leap” with New London Office

Crowdfund insider, Posted October 26, 2023

UK’s “greener” digital bank Tandem has committed to a new office in London, “reconfirming its commitment to the UK’s fintech capital.”

The new site, located in 10 Bloomsbury Way, London WC1A 2SL “offers an excellent location with facilities and infrastructure, enabling Tandem to add yet another greener office space to its expanding facilities portfolio, moving from a D EPC rating to a B EPC.”

The Bloomsbury Building will reportedly house “the challenger bank’s Marketing, Treasury,Risk and Strategy teams. And being located within the City, ensures it remains close to the wider professional services and fintech ecosystems.”

Alex Mollart, Tandem’s CEO, said:

“This move marks another milestone for Tandem. After a strong year of growth and breaking into an underlying profit for the first time last year, I’m excited about our evolution and what the future holds – including an exciting roadmap of greener products and propositions. London is a core component. We’re proud to have our HQ in Blackpool and be part of the Fintech revolution taking place in the North, but as the UK’s greener digital bank, London remains a crucial location for us and the UK’s fintech scene as a whole. The new office is in the heart of it – I’m glad we can continue our commitment and support the growing fintech scene.”

While a hybrid working scheme remains in place, the new office will “be home to around 50 Tandem employees, as well as offering hot desks to accommodate any of the 500 employees visiting from the bank’s four other sites and remote workers.”

#Digital bank

Sepa payment schemes ISO 20022 migration delayed

Finextra, Posted October 23, 2023

The European Payments Council has postponed the migration of Sepa payment schemes to the 2019 version of ISO 20022 by four months, to March, after concluding that “at least two large Sepa countries” couldn’t be guaranteed to make the original November deadline.

Four schemes – Sepa Credit Transfer, Sepa Instant Credit Transfer, Sepa Direct Debit Core, and SDD Business-to-Business – were slated to migrate on 19 November.

However, the EPC says that after talking to participants it has concluded that operational delays and the need for additional testing means that some counties are not ready.

Pushing ahead with the original date would not only have affected payment service providers within these counties but also cross-border Sepa transactions, with potential knock-on effects for the whole region.

#Payments

Curve launches credit card in the UK

IBS Intelligence, Posted October 27, 2023

Financial super app Curve, which consolidates debit and credit cards into one card and app, has announced the launch of a card in the UK that offers Section 75 protection.

The new Curve credit card has all the functionalities of Curve, upgraded with increased security and flexibility. The all-in-one payment card is set to provide Section 75 protection to every card in the customer’s wallet, aiming to become the most secure and flexible credit card on the market.

Per the announcement information, customers link their existing credit cards to a digital Curve Wallet, and whichever card they select in the app is then charged when leveraging their Curve credit card to pay. A differentiator that makes Curve credit cards safe and secure payment methods is that with Curve now being a credit card, all eligible purchases have Section 75 protection, even those charged to a debit card.

#App

UniCredit and Alpha Services and Holdings announce merger and partnership

The Paypers, Posted October 25, 2023

UniCredit and Alpha Services and Holdings have announced the signing of a merger in Romania and a partnership in Greece. The two parties have agreed on the key economic terms for the merger of UniCredit Bank with Alpha Bank Romania, to create the third largest bank in the local market with a combined 12% market share by total assets. The merger combines two complementary franchises in the country, with UniCredit Romania and Alpha Bank Romania having footholds in the corporate and retail segments.

As per the press release, the transaction closing is expected in 2024, subject to the completion of a due diligence process, corporate approvals for the merger, and necessary regulatory approvals. After the completion, Alpha Bank is expected to retain 9.9% of the combined entity share capital and receive a cash consideration of EUR 300 million. The cash component remains subject to post-due diligence adjustments related to asset quality. The merger is set to grant customers of Alpha Bank Romania access to an enlarged range of services and products.

#UniCredit

Revolut adds European listed stocks to its trading platform

The Paypers, Posted October 24, 2023

Financial super app Revolut has included stocks of multiple European-listed companies and firms in its investment offering across the European Economic Area.

Following this announcement, customers of the company across the EEA will be given the possibility to trade fractional stocks of 70+ European-listed firms and businesses, with a minimum investment amount of 1 EUR. The investment solutions in the European Economic Area are provided by the Revolut Securities Europe UAB.

By leveraging Revolut, the trading process will also be commission-free within allowed subscription plan limits. Furthermore, with access to multiple European-listed stocks, US-traded companies, and Exchange Traded Funds (ETFs), users and clients will be allowed to check the performance of their investments in real-time, with live trading charts, market news, and watchlists within the application.

#Revolut

USA

Apple Pay Later launches in the US

The Paypers, Posted October 27, 2023

Apple has launched Apple Pay Later for eligible US residents and it is currently available in the Wallet app on the iPhone.

Until now, the feature was available on an invite-only early access basis, with Apple announcing it at the end of March 2023. At that time, randomly selected users were granted access to a pre release version of Apple Pay Later via Wallet and through their Apple ID email.

Apple Pay Later is a Buy Now, Pay Later (BNPL) feature that allows users to divide purchases into four payments over six weeks, with no interest or fees. Customers can track, manage, and repay their loans in the Apple Wallet, with the capability being available for qualified purchases between USD 75 and USD 1000. Initially, the minimum purchase amount was USD 50, however, Apple raised it to the current USD 75. Purchases can be made either on iPhone or iPad on the majority of websites and apps that accept Apple Pay.

#Apple Pay Later

BNPL Usage May Increase with “Reasonable” Repayment Terms, Study Finds

Crowdfund insider, Posted October 23, 2023

It’s been several years since financial services upstarts reimagined buy now pay later (BNPL) as a point-of-sale (POS) payment method.

Since then, this once-obscure way of transacting has “been placed front and center at the checkout by merchants worldwide, and 28% of U.S. consumers now say they’ve used it at least once in the previous 90 days.”

But who, exactly, are these BNPL customers and why are they choosing this form of payment over countless other options? While many reports have “suggested that BNPL has been most attractive to financially vulnerable consumers who are already overextended on their credit cards, the real BNPL customer profile is decidedly more nuanced.”

In fact, according to findings from the J.D. Power 2023 POS Choice Satisfaction Study, BNPL is attracting consumers “from across the financial health spectrum, and most consumers are drawn to it for the same primary reason—they like the repayment terms.”

Both credit cards and BNPL allow consumers “to make purchases they may not be able to pay for immediately.”

#BNPL

Mastercard Expands Services with AI and Economics Practices

Crowdfund insider, Posted October 26, 2023

Mastercard (NYSE: MA) announced the expansion of its consulting business with the launch of new practices dedicated to artificial intelligence and economics “to help clients across all industries rapidly and responsibly advance the use of AI and address ever-shifting macro-economic forces and consumer preferences.”

The company is also “enhancing its business transformation service, Digital Labs, for clients to create end-to-end solutions from concept development and rapid prototyping to launch and scalability.”

These offerings are part of Mastercard’s ongoing consulting expansion “into emerging sectors to support businesses in their evolution and growth enterprise-wide.”

Raj Seshadri, president of Data & Services, Mastercard, said:

“With the democratization of generative AI and a complex economic climate, companies need expertise and go-to-market solutions now more than ever. As a complement to our advisory practices, Digital Labs serves as an incubator for businesses to explore new ideas and co-create innovative solutions with a streamlined effect on implementation.”

Backed by over a decade of expertise using AI models “to safeguard more than 125 billion transactions annually, Mastercard’s AI consulting practice works with businesses to adopt relevant and responsible AI strategies.”

#Mastercard

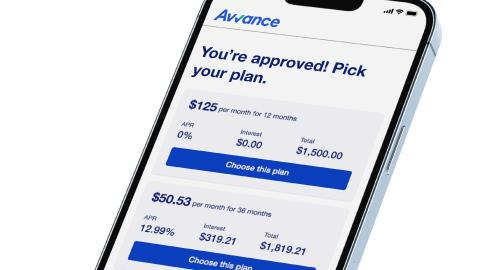

US Bank launches POS lending tech

Finextra, Posted October 25, 2023

US Bank has launched an embedded, multi-channel point-of-sale lending platform that lets firms offer customers financing at the checkout.

Called Avvance, the bank-backed option promises a quick application process and instant decisioning for personalised loans.

US Bank says that Avvance provides shoppers with convenience and flexibility while giving businesses a new payment option from a trusted provider without the hassle of managing payments after the sale.

Mia Huntington, EVP, BNPL and POS lending, US Bank and Elavon, says: “With Avvance, business owners have the ability to attract new customers while increasing their buying power, resulting in increased sales.

#US Bank

Marqeta launches a new credit card platform

The Paypers, Posted October 24, 2023

US-based card issuing platform Marqeta has launched a new credit card platform to help companies improve customer engagement and create loyalty strategies.

This new development aims to establish a comprehensive solution for launching both consumer and commercial credit programmes, as it allows brands to set a fresh standard for credit cards by fostering increased customer loyalty through personalised rewards and taking full control of the customer experience.

Marqeta’s expanded credit offering aims to solidify the platform as an all-encompassing solution for Embedded Finance, accommodating various card types and formats within the same platform. It gives customers the ability to create personalised credit card products designed to enhance cardholder engagement, all without the need to contend with outdated legacy technology or piece together solutions from various vendors.

In essence, customers can now bypass the intricacies of working with legacy infrastructure or disparate solutions, using a single, modern tech stack that has been proven at scale. They can develop credit products tailored to the specific needs of both consumer and commercial cardholders, integrating these experiences into their existing web and mobile applications.

#Credit card platform

Mastercard further expands consulting services

The Paypers, Posted October 24, 2023

Mastercard has expanded its consulting services, focusing on AI and economics, aiding businesses in AI adoption, customer experience, and revenue growth.

Mastercard announced the expansion of its consulting business with the launch of new practices dedicated to artificial intelligence and economics, to help clients across all industries rapidly and responsibly advance the use of AI and address ever shifting macro-economic forces and consumer preferences.

The company is also enhancing its business transformation service, Digital Labs, for clients to create end-to-end solutions from concept development and rapid prototyping to launch and scalability. These offerings are part Mastercard’s ongoing consulting expansion into emerging sectors to support businesses in their evolution and growth enterprise-wide.

Officials from Mastercard said that with the democratisation of generative AI and a complex economic climate, companies need expertise and go-to-market solutions now more than ever. As a complement to their advisory practices, Digital Labs serves as an incubator for businesses to explore new ideas and co-create innovative solutions with a streamlined effect on implementation.

#Mastercard

LatAm

Colombia’s Nequi taps TerraPay for international remittances

Fintech Futures, Posted October 25, 2023

Nequi, a financial mobile banking app from Bancolombia, has tapped the UK-based payments infrastructure firm TerraPay to equip its customers in Colombia with a wider remittance network.

The partnership will extend its network to over 200 countries while reducing the amount of time and cost of receiving funds internationally. TerraPay is currently registered and regulated across 29 of those countries.

The pair announced the partnership at this year’s Money20/20 USA in Las Vegas, saying that it builds upon their “shared values” for financial inclusion and accessibility while affording Nequi’s customers greater autonomy over their finances.

Delivered by one of the largest commercial banks in Colombia, the Nequi app facilitates a variety of digital financial services, including online bank accounts, digital wallets and the ability to complete utility payments, and claims to currently have 17.5 million users.

#Fintech

Airwallex enters Latin America with MexPago acquisition

Fintech Futures, Posted October 19, 2023

Fintech unicorn Airwallex is expanding into Latin America with the acquisition of Mexican payment service provider MexPago.

The deal is subject to regulatory approvals and customary closing conditions and financial terms have not been disclosed.

Describing itself as a “global payments and financial platform for modern businesses”, Airwallex offers embedded finance products and payments, treasury and spend management solutions built to help companies grow and operate across borders.

It says the deal to buy MexPago is “an important part of Airwallex’s broader growth strategy in the Americas, where the company has seen more than 460% YOY revenue growth”.

#Fintech

High Income-focused Digital Bank Nubank Extends Ultravioleta Client Benefits

Crowdfund insider, Posted October 24, 2023

Nubank (NYSE:NU), which claims to be one of the world’s largest digital financial services platforms, announces a new curation of exclusive benefits for its Ultravioleta customers.

In addition to the black credit card offering 1% cashback, users will have access to constantly evolving solutions, “focused on simplifying and facilitating users’ financial lives. The new feature is in the testing phase and will be gradually released to the user base in the coming months.”

Livia Chanes, operations leader at Nubank in Brazil, said:

“Focused on the high-income segment, our first step is to evolve and reposition Nubank Ultravioleta, going far beyond the standard benefits of a black credit card. The idea is to offer a curation of solutions to address complex details of financial life that often go unnoticed.”

Nubank Ultravioleta customers will have access “to exclusive solutions and the traditional benefits of the Mastercard Black credit card.”

#Fintech

dLocal and inDrive bring cashless solution to Brazil

The Paypers, Posted October 27, 2023

Mobility and urban services platform inDrive has partnered with payments platform dLocal to simplify payment methods for drivers and riders in Brazil with a cashless solution.

inDrive has added a new payment solution to its app in Brazil thanks to dLocal, a tech-first payments platform that enables global enterprises to connect with billions of consumers in emerging markets.

Per the announcement information, the latest integration between dLocal and inDrive is dLocal for Platforms, dLocal’s payment infrastructure for marketplaces launched in April 2023. The Platforms service enables the fastest and easiest way to accept payments and disburse funds to sub-accounts within a single solution and inDrive has launched the all-in-one product in Brazil to employ cashless solutions for its riders and drivers. Brazil marks the first region globally where inDrive implemented a cashless solution.

#Fintech

Thank You for reading us!

Finstar PR Department