Dear Colleagues!

Kindly find our weekly fintech and banking newsletter. If you do not want to receive it, you can unsubscribe from the mailing list at the bottom of the page.

Yours faithfully,

Finstar PR Department

Аsia

Central banks see future for global instant payments via mobile phones

Finextra, Posted March 23, 2023

Central banks in Italy, Malaysia and Singapore have laudeed successful tests of cross-border instant payments via mobile phones.

The year-long tests were overseen by the Bank for International Settlements Innovation Hub in Singapore under the banner Project Nexus.

Test payments were initiated using only the mobile phone numbers or the recipients’ company registration numbers via the Eurosystem’s Target Instant Payment Settlement (TIPS), Malaysia’s Real-time Retail Payments Platform (RPP) and Singapore’s Fast and Secure Transfers (FAST) payment system.

“I am thrilled at our success in connecting three national payment systems and the potential this indicates for Nexus,” says Cecilia Skingsley, head of the BIS Innovation Hub. “It paves the way for further development, and we look forward to collaborating with our partner central banks on the next phase of the project.”

#Central Banks

1982 Ventures backs new Indonesian crypto exchange platform

Tech in Asia, Posted March 30, 2023

Despite the bear market, the crypto market in Indonesia isn’t showing signs of slowing down. With about 12 million people in the country now owning cryptocurrency, digital asset exchanges continue to emerge.

One such platform is Mobee, which was founded in 2022 by Andrew Tjahyadikarta and Jeff Pradana. The Jakarta-based company aims to serve users seeking passive income and active investors interested in more sophisticated wealth management products.

Mobee recently obtained a license from Bappebti, Indonesia’s regulatory body for trading digital assets.

#Crypto

Indian lendtech Stashfin secures $100m in debt funding

Fintech Futures, Posted March 24, 2023

Indian lendtech start-up Stashfin has secured $100 million in a debt funding round led by InnoVen Capital and Trifecta Capital.

The latest funding follows the company’s $270 million Series C round held in June last year, which valued the firm at over $700 million.

Founded in 2016 and headquartered in New Delhi, Stashfin aims to bring financial services to underbanked populations across India. The firm offers credit with flexible interest rates and helps customers build their credit scores. It was acquired by Singapore-based Morus Technologies in 2017.

With the new funding, Stashfin plans to grow its business further as it aims to reach more customers across the country.

“The new collaborations will add more velocity to our growth given our robust business model and extensive market demand,” says Tushar Aggarwal, CEO and founder of Stashfin.

#Startup

Singapore’s Kredivo Holdings secures $270m in Series D funding

TechCrunch, Posted March 22, 2023

Singapore-based digital financial services platform Kredivo Holdings has secured $270 million in a Series D equity funding round led by Japanese banking giant Mizuho Bank, a subsidiary of Mizuho Financial Group.

Existing investors including Square Peg Capital, Jungle Ventures, Naver Financial Corporation, GMO Venture Partners and Openspace Ventures also took part in the round, among others.

Formerly known as FinAccel, Kredivo Holdings is the parent company of buy now, pay later (BNPL) firm Kredivo, which operates in Indonesia and Vietnam, and digital credit platform KrediFazz. Kredivo Holdings says the funding will support the launch of its upcoming neobank Krom Bank Indonesia. Kredivo Holdings (then FinAccel) acquired a majority stake in Krom (formerly Bank Bisnis Internasional) in April last year.

#Fintech

Europe

Authorities raid major French banks in EUR 100 bln fraud investigation

The Paypers, Posted March 30, 2023

French authorities have conducted multiple raids on five major banks in the country as part of an investigation into possible fiscal fraud and money laundering, according to Finbold.

The banks in question include BNP Paribas, Société Générale, Exane, Natixis, and HSBC. The probe is linked to the legally questionable ‘cum/cum’ practice, in which banks create complicated legal structures to allow wealthy clients to get around the taxation of dividends. The investigations are suspected to be connected to a case that may have cost the French and German governments over EUR 100 billion (USD 108 billion).

The raids were carried out by 16 investigating judges and over 150 investigation agents, and involved six prosecutors from the western German city of Cologne. The banks in question are suspected of aggravated tax fraud laundering, while BNP and Exane are facing suspicions of aggravated tax fraud. The investigations began in December 2021 and required several months of preparation, according to a statement by the French Financial Prosecutor’s Office.

#French Banks

Neobank Relio receives FINMA fintech license

The Paypers, Posted March 29, 2023

Switzerland-based neobank Relio has received a fintech license from the Swiss Financial Market Supervisory Authority (FINMA) and must now wait for the approval of the supervisory authority to go live.

Relio relies on vertical banking and focuses on SMEs and start-ups. Opening an account for SMEs that do not fit into the standard compliance procedure often takes a long time. Once the account is finally opened, changing cash flows, payments from new countries, or other factors can lead to the temporary blocking of accounts at classic banks, and in the worst case to the expulsion of the SME. Relio has supported its business model with an algorithm that largely automates and processes compliance. The neobank aims to allow complex SMEs to get their accounts opened faster than classic banks could. This process should take up to 24 hours for SMEs with little complexity, approximately 2 days for those that are quite complex, and a maximum of a few days for very complex SMEs. Even after the account has been opened, irregularities or deviations from the norm in day-to-day business should not lead to account closures. Relio aims to act quickly and efficiently beyond the algorithms procedures, for example with manual checks and clarifications.

#Fintech

Turkey-based QNB Finansbank rolls out account aggregation tool

The Paypers, Posted March 29, 2023

QNB Finansbank Digital Bridge, a banking and financial services provider in Turkey, has announced the launch of a new service for companies called the ‘All Banks’ application, according to PSM.

Developed in line with the Open Banking legislation, this new solution allows companies to access multiple bank accounts through the Digital Bridge Platform. The ‘All Banks’ application also reportedly provides a comprehensive view of detailed account activities and enables fund transfers.

Through the supposed user-friendly interface of the Digital Bridge Platform, QNB Finansbank Digital Bridge users can access the ‘All Banks’ application directly or through internet and mobile banking within the platform. This makes it possible for companies to collect account information from multiple banks in one place, increasing efficiency and saving time, according to PSM.

#Fintech

UK open banking sector valued at £4.1bn by Coadec

Altfi, Posted March 29, 2023

Over 4,800 UK jobs have been created by the introduction of open banking in the UK, an industry now worth more than £4.1bn to the economy, yet the sector now sits at a “vital crossroads” in its development.

That’s the findings of a new analysis of the UK’s open banking ecosystem by policy group Coadec, which collected data from 82 private fintechs with either Account Information Service Provision (AISP) or Payment Initiation Service Provision (PISP) licences.

These firms raised a combined £886m in fresh funding during 2022 alone.

“The growth of Open Banking has been a UK-led marvel,” said Luke Kosky, fintech policy lead at Coadec.

#Open Banking

European Fintech Inpay Posts Solid Results, Announces UK Expansion Plans

Crowdfund Insider, Posted March 29, 2023

Inpay’s Annual Report for 2022, released at the company’s AGM in Copenhagen, Denmark, announced solid results “for the international payments firm and outlined plans for significant future growth within their UK office (London) and internationally across Asia, the Middle East and Europe.”

The Danish-owned fintech company claims it “has seen revenues grow by almost £35 million since 2018.”

The growth is “attributed to Inpay’s revolutionary approach and software technology, which is modernizing the cross-border payments industry – a market where 97% of transfers are currently processed by traditional, old-fashioned, slow and expensive bank transfers.”

Thomas Jul, CEO of Inpay comments:

“We are extremely pleased with the results for 2022, which have provided a strong foundation for future growth and value creation for our customers, society and other stakeholders. With the structural changes and exceptional senior talent we have brought on board in 2022, we are ready to sustainably accelerate our growth and expand further over the coming years, with the continued goal of democratising payments across the globe.”

#Fintech

UK government abandons Sunak’s NFT plan

Finextra, Posted March 28, 2023

The UK government has ditched Prime Minister Rishi Sunak’s plan to get the Royal Mint to create a non-fungible token.

Sunak asked for the NFT to be created last April, when he was Chancellor of the Exchequer. At the time, the Treasury tweeted: “This decision shows the forward looking approach we are determined to take towards cryptoassets in the UK.”

However, economic secretary Andrew Griffith now says: “In consultation with HM Treasury, the Royal Mint is not proceeding with the launch of a non-fungible token at this time but will keep this proposal under review.”

Labour’s shadow City minister Tulip Siddiq responds. “I’m glad that the Royal Mint has finally made the Conservatives see sense, but we’ve been calling on the chancellor to drop this crypto gimmick for months.”

#Fintech

USA

Apple finally launches Pay Later in the US

Altfi, Posted March 29, 2023

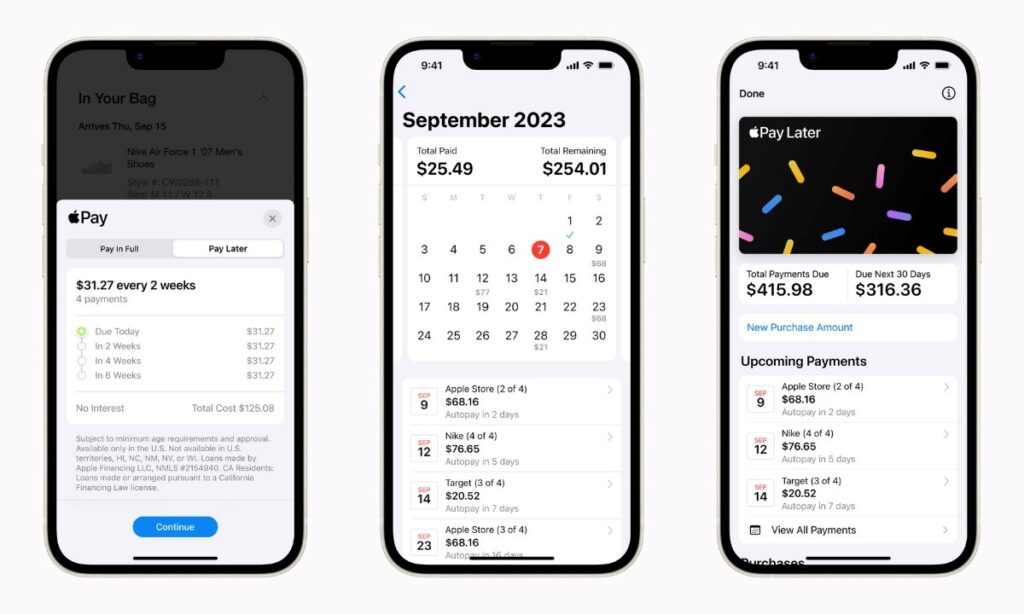

Nine months after announcing it would be entering the ‘buy now, pay later’ (BNPL) space, Apple’s Pay Later baby has finally arrived.

Now live in the US, Apple’s product set to rival the likes of Klarna and Affirm will give users the option to split their purchases into four equal payments across six weeks, with no interest and no fees.

Apple users will be able to track, manage and repay their loans through their Apple Wallets on their iPhones and iPads, and can apply for loans of $50 to $1,000, which can be used for online and in-app purchases at merchants that accept Apple Pay.

“There’s no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we’re excited to provide our users with Apple Pay Later,” Apple’s vice president of Apple Pay and Apple Wallet Jennifer Bailey said.

“Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions.”

#BNPL

New AltFi Research report: Embedded Finance – The New Frontier Of Lending

Altfi, Posted March 28, 2023

The path towards embedded finance is well underway, tracing back to the early days of eCommerce when PayPal and Amazon integrated payments into their checkout flow.

Today, lending has joined the embedded trend with buy now, pay later leading the way towards seamless lending experiences. Many lenders are adapting their offerings to become embedded, and insurance is poised to be the next significant vertical in this space, with the potential to become a $700bn industry.

As the adoption of embedded financial services continues, there remains a question of whether consumers are ready for these services and which ones they will be comfortable with.

AltFi Research, in partnership with Freedom Finance, Provenir and SAP Fioneer, is proud to present our latest report exploring this topic, Embedded Finance: The New Frontier Of Lending.

#Report

Big banks invest in generative AI startup Hazy

Finextra, Posted March 28, 2023

Nationwide Building Society, Wells Fargo and Intesa Sanpaolo have joined a $9 million Series A funding round for British synthetic data disruptor Hazy.

The round was led by Conviction, with participation from UCL Technology Fund, M12 (Microsoft), ACT Venture Partners, Terra VC, Evenlode, Logo Ventures and Sarus Ventures.

Founded in 2017 and originally a University College London spinout, Hazy uses AI-generated smart synthetic data that preserves the statistical quality of the real data but contains no real information, eliminating the privacy risk.

This means it can be used as a drop-in replacement for real data with AI/ML development, software testing and data commercialisation use cases.

#Startup

Investors of the world unite! Fintech Tulipshare launches activist platform

Altfi, Posted March 29, 2023

Tulipshare’s mission is to “unite investors around the world” to bring about change that traditional brokers, asset managers and institutional investors have not.

A huge number of adults hold some sort of company share whether it be directly, in a pension or ISA or mutual fund. Very few know or exercise the right to use their shareholder voting rights.

Tulipshare, an activist retail investor fintech, has launched a new platform to boost turnout at shareholder meetings.

Tulipshare’s ‘Pledge Your Share’ (PYS) platform gives early access to shareholder proposals. These can then be voted on at companies’ annual general meetings. Users ‘pledge’ their shares to a specific campaign or shareholder proposal.

“Most people, due to no fault of their own, do not know that every share has shareholder rights attached to it. When those shareholder rights are utilised in the correct way, they can be used to drive positive change in a company,” said Antoine Argouges, CEO and founder of Tulipshare.

“By engaging with publicly-held companies, Tulipshare will look to help investors push for stronger environmental and social commitments and ensure the companies we invest our money in are being responsibly managed by accountable leadership,” he added.

#Fintech

Fintech Firm DailyPay Introduces New Feature for Hospitality and Restaurant Clients

Crowdfund Insider, Posted March 28, 2023

DailyPay claims that it continues to innovate its technology platform with a new function created “to tackle a growing problem among tipped employees within the hospitality industry.”

For parking valets, restaurant servers, porters, and hotel concierges, the recent trend for customers “to go cashless can put a huge dent in their finances.”

This shift in consumer behavior can “drive many from the industry and negatively affect a company’s ability to recruit and retain employees in the field.”

To address this problem facing its clients, especially those in hospitality, DailyPay is rolling out a new function, “Friday Tips.”

#DailyPay

First Citizens Bank Acquires Silicon Valley Bank as Whole Bank Purchase, Shares Jump on the News

Crowdfund Insider, Posted March 27, 2023

First Citizens BancShares, Inc. has entered into an agreement with the Federal Deposit Insurance Corporation (FDIC) to purchase all of the assets and liabilities of Silicon Valley Bridge Bank, N.A.

SVB failed earlier this month and was taken over by regulators as its balance sheet went upside down and a bank run made things worse. SVB’s problem was its long-duration assets that had declined in value due to rising interest rates. This, combined with the fact that over 90% of the accounts were over the $250,000 insurance threshold, raised fears of contagion. In the following days, the federal government announced that all deposits would be covered in a dramatic move to stifle fear and uncertainty about the banking system.

According to First Citizens, which is based in North Carolina, the transaction has been structured as a whole bank purchase and assumption agreement with loss share coverage.

Share of First Citizens rose dramatically in early trading – by over 44% at the time of this report.

#SVB

Fintech ZEBEDEE to Enhance International Payments with Tech Connecting US, UK, EU, Brazil, the Philippines

Crowdfund Insider, Posted March 29, 2023

ZEBEDEE, a payments processor, has announced an overhaul of how users can move money across the world.

The upgraded feature for borderless transactions showcases “the power and potential of global, friction-free and currency-agnostic payments and represents a significant improvement and simplification of how anyone can use Bitcoin to move money online.”

ZEBEDEE builds its tech “on the open Bitcoin Lightning Network, which means users can send and receive funds from any other Lightning wallet or service.”

With today’s announcement, ZEBEDEE accounts can now “connect directly to platforms of select launch partners around the world, headed by Pouch.ph (Philippines) and Bipa (Brazil). It works similarly to open-banking standards where users connect a bank account once and can seamlessly move money to and from the account, but is even simpler to use and much more flexible.”

#Fintech

LatAm

Digital Banking: Nubank Supports Financial Inclusion of 5.7M Brazilians in Credit Market in One Year

Crowdfund Insider, Posted March 28, 2023

Nubank reveals that it has supported the financial inclusion of 5.7 million Brazilians in the credit card market in one year, according to a study released by Data Nubank – the company’s research and analysis platform on finances.

The survey analyzed “the spending and investment profile of customers with no credit history, and who gained their first access to credit through the fintech, based on data between July 2021 and July 2022.”

For this group, the profile of greater adherence “to credit is of people with a monthly income of up to BRL 2,500.00, which accounted for 80.2% of the total of people who had access to a credit product for the first time through Nubank.”

#Nubank

Thank You for reading us!

Finstar PR Department