Dear Colleagues!

Kindly find our weekly fintech and banking newsletter. If you do not want to receive it, you can unsubscribe from the mailing list at the bottom of the page.

Yours faithfully,

Finstar PR Department

Аsia

iFAST launches digital banking platform

The Paypers, Posted April 26, 2023

Singapore-based company iFAST has launched its digital personal banking platform, focused on offering access to personal banking services to global customers.

Following this launch, the company will have the possibility to provide its DPB customers around the world with online personal banking services. They will also be able to hold, spend, and send their money across sic currencies, without paying any fees and having the capability to earn interest as they use it. The currently available currencies are GBP, USD, EUR, SGD, CNY, and HKD.

Clients will be able to open accounts on the iFAST Fintech Ecosystem in order to gain access to personal banking services in a seamless and secure manner.

The account holders will be allowed to link up their iGB digital banking accounts with different platforms that are available within iFAST Corporation. Included in the list of services are FSMOne.com, iFAST Financial, as well as the iFAST Global Markets platforms and tools that are incorporated into the markets iFAST has a presence in.

#Banking platformnking

South Korea’s Kakao Pay eyes majority stake in Siebert

Fintech Future, Posted April 27, 2023

South Korean fintech Kakao Pay has acquired a 19.9% stake in US-based financial services firm Siebert Financial Corp for approximately $17 million.

Following the initial deal, the company also plans to buy an additional 31.1% of newly issued Siebert shares in a second transaction, subject to shareholder and regulatory approvals.

Once the second purchase is finalised, Kakao Pay will become a majority shareholder of Siebert with 51% ownership.

Siebert says that current majority shareholders, the Gebbia family, will continue to hold a “significant” ownership in the firm. The company’s current management team, led by the Gebbia family, will also continue to operate as usual.

Founded in 1967 and headquartered in New York, Siebert provides a range of brokerage and financial advisory services including securities brokerage, investment advisory and insurance offerings, securities lending and corporate stock plan administration solutions.

#Fintech

UOB to invest S$500 million to build global technology and innovation centre

Finextra Posted April 26, 2023

UOB is to invest S$500 million to build a new global technology and innovation centre in Singapore’s Punggol Digital District (PDD)

Under the commitment, UOB becomes the first local bank to establish its presence in Singapore’s first smart and sustainable business district, and is the largest commercial investor in PDD to date.

Targeted to be completed by the end of 2026, the 300,000 square feet centre will house around 3,000 staff engaging in technology, innovation and digital roles. The new centre will offer high-performance workplaces and will be fitted with energy-saving features, in line with the sustainability nature of the district.

UOB in 2021 announced plans to invest up to $500 million in digital innovation initiatives as it seeks to double the retail customers it serves digitally to more than seven million customers across Asean by 2026. This entailed the combination of its Thailand-based digital bank TMRW with the scale and product depth of its mobile app UOB Mighty on one platform. It now lays claim to being the only Singapore bank that has standardised its regional technology platform across Asean.

#Fintech

Europe

Finastra partners with Corvallis

The Paypers, Posted April 27, 2023

Finastra has partnered with Corvallis, an IT provider in the Italian financial services sector, to support Italian banks with their digital transformation journeys.

Corvallis clients can change their business models, accept new ideas, and adjust fast to their customers’ expectations with Finastra’s Essence, a SaaS solution hosted in the cloud via Microsoft Azure.

Cloud usage is growing in importance in Italy for all financial institutions, giving better economies and flexibility to the industry, allowing banks to scale as needed, optimise resources, and improve security. Deploying Essence will allow them to alter their operations at a lower cost while still providing their consumers with the end-to-end, personalised, and seamless experiences they want.

Essence is a cloud-first, next-generation digital banking system that combines complex functionality and cutting-edge technology to boost organisational agility, save costs, and increase operational efficiency. Essence’s retail and commercial banking capability, powered by open architecture and linked with FusionFabric.cloud, enables institutions to build products and services swiftlybuild products and services. Banks may also use Finastra’s Retail Analytics module, which provides a 360-degree perspective and converts raw data into meaningful insights. Corvallis offers implementation knowledge as well as supplementary solutions for anti-money laundering (AML), payment and settlement, and fraud management.

#Fintech

Holland & Barrett implements Trustly’s Open Banking payment method to UK online store

The Paypers, Posted April 26, 2023

Holland & Barrett, a health and wellness retailer in the UK, has integrated Trustly’s Open Banking-based payment method into its online store, according to Fintech Finance News.

Customers can now pay directly from their bank account during checkout. Holland & Barrett reportedly is the first major ecommerce partner for Trustly in the UK since its acquisition of Open Banking platform provider Ecospend. By implementing Trustly’s services, Holland & Barrett hopes to address payment challenges such as refunds, reconciliation, and rising payment costs. The integration was made possible by Trustly’s long-term relationship with Adyen, Holland & Barrett’s payment gateway provider, according to ffnews.com.

According to Trustly’s Chief Product Officer, Daniel Hecker, this partnership with Holland & Barrett will provide customers with easier and improved payment solutions while also supporting the retailer’s growth. He notes that UK retailers are increasingly turning to account-to-account payments, as they modernise their payment methods and checkout technology.

Jonathan Haywood, Director of Omnichannel Customer Development at Holland & Barrett, highlights the company’s significant daily transaction volume and its commitment to providing great service to customers. He praises Trustly’s solution for its effectiveness and expects rapid adoption of the technology, according to Fintech Finance News.

#Fintech

Pocket money app MyMonii expands to Germany

The Paypers, Posted April 26, 2023

Denmark-based pocket money app MyMonii has announced launching in Germany.

The fintech offers an app with an optional Visa prepaid card designed to help families manage their children’s pocket money and teach them how to manage their finances. According to the provider, habits in dealing with finances are formed at a young age, meaning that parents should have conversations with their children at an early age to teach them how to deal with money. Seeing as young people nowadays grow up mainly with money in digital form, it is particularly important to help them keep track, as a MyMonii representative informs.

The app provides an easy overview of savings and expenses for both parents and their children. Optionally, savings goals and monetary incentives for completing (household) tasks could be set. Children and young people can pay with the MyMonii Visa card anywhere that Visa cards are accepted, including abroad and online (except in shops and on websites that have been blocked by MyMonii because they are not suitable for children and young people). Additionally, parents and kids could also check the PIN code and 3DS password for online purchases in the app. Seeing as it is a prepaid card, it is not linked directly to a bank account. This means that only as much money can be spent as is available in the child’s MyMonii account.

#App

Raiffeisenlandesbank to offer crypto investments

Finextra, Posted April 27, 2023

Austria’s Raiffeisenlandesbank aims to become the first traditional European bank to incorporate cryptocurrencies and other digital assets into its investment offering for clients.

The co-operative banking group is tapping technology from BitPanda Technology Solutions to proviode the SaS trading infrastructure to deliver on its ambitions. The Austrian crypto tech firm will furnish RLB NÖ-Wien with API connectivity to its digital asset exchange wrapped in a white label package.

Users will be able to invest from as little one euro. Crypto investment will be featured alongside digital investment services for stocks, exchange-traded funds, precious metals and commodities.

“In the spirit of absolute customer focus, we stand by our customers as a reliable and strong partner. Personal advice is just as important as digital solutions that are up-to-date,” emphasises Michael Höllerer, CEO of Raiffeisenlandesbank NÖ-Wien: “The deal with Bitpanda aims to expand our product range with an innovative, secure facet and enable all customers to easily accumulate wealth.”

#Crypto

Exclusive: Moneybox mothballing crypto launch. Will other fintechs follow?

Altfi, Posted April 27, 2023

A year after AltFi revealed Moneybox’s crypto ambitions, the company says it is ‘de-prioritising’ its crypto plans for now, owing to changing market conditions.

The digital investing and savings app is one of the original UK fintech success stories. Founded in 2015, and launched in 2016 it brought ‘round ups’ to the UK. A feature pioneered by Acorns in the US, which acted as a highly successful ‘wedge’ product that allowed it to expand to be a one-stop shop for pensions, ISAs, cash savings and more.

Therefore, when it was revealed – exclusively by AltFi – last year in April that it was planning to launch a crypto product it came as no surprise. However, not long after crypto began to face an ongoing period of existential crisis initially dubbed as just another ‘crypto winter’ but which eventually began to snowball to bring down one of the largest fintech platforms in the world FTX.

#Fintech

‘Gradual homeownership’ fintech Wayhome raises £8m Series A

Altfi, Posted April 27, 2023

The part-buy, part-rent provider hopes to double the number of homebuyers it can help in the next 12 months.

Wayhome has closed a Series A equity round of £8m to disrupt the home buying space.

A gradual home ownership provider, Wayhome gives customers the option to part-buy and part-rent their homes.

They can start out with just a 5 per cent deposit, pay rent on the part of the home they don’t own and whatever they pay that is over the cost of rent goes towards buying more of the home.

“Due to the way that the Gradual Homeownership model works, the rising interest rates seen since September’s controversial mini-budget have delivered even greater demand for our product,” Wayhome CEO Nigel Purves said.

#Fintech

Lithuania: Big Data Analysis Firm Palantir Technologies to Establish Hub in Vilnius

Crowdfund Insider, Posted April 27, 2023

Palantir Technologies Inc., a software and services company which specializes in big data analysis, plans “to expand its operations in Lithuania, after entering into a strategic partnership, together with the Ministry of Defense of Lithuania.”

Both parties are planning “to collaborate in developing new digital solutions.”

Alexander C. Karp, co-founder and chief executive officer of Palantir Technologies Inc. and chairman of The Palantir Foundation for Defense Policy & International Affairs, said:

“The critical role Lithuania plays on the world stage will only continue to increase with the current arc of our geopolitics. We are more than grateful to the President of Lithuania for our new partnership with the Ministry of Defense to establish a technical center in Vilnius, which will strengthen not only the nation and its Baltic partners, but also the democratic values which they seek to uphold.”

The strategic partnership with Lithuania is oriented “towards the development of technological solutions with the purpose of supporting regional defense capabilities.”

Palantir Technologies team in Lithuania “would be looking to hire highly skilled software engineers.”

The Ministry has agreed “to give insights on the possible applicability of products to defence areas and further development.”

#Fintech

USA

Rego Payment Architectures partners with ENACOMM

The Paypers, Posted April 27, 2023

White-label digital wallet platform provider for FIs Rego Payment Architectures has entered a three-year agreement with fintech ENACOMM as its data integration platform.

Following this collaboration, ENACOMM’s Open API stack provides REGO with access to banking cores throughout the US to offer financial institutions its certified COPPA and GDPR-compliant white-label family wallet.

As a digital family wallet platform that is certified COPPA and GDPR-compliant, REGO is primarily built as a white-label solution for banks and credit unions no matter the size. Due to the agreement with ENACOMM, REGO is enabled to integrate with banking cores leveraged by financial institutions throughout the US.

#Payments

PaperTrl partners with US Bank

The Paypers, Posted April 27, 2023

PaperTrl has announced the partnership with US Bank, explaining that the integration will enable customers to automate their AP operations from procurement to payment.

Construction companies can now reportedly simplify their accounts payable (AP) processes with the help of PaperTrl’s innovative AP management and automation platform, which has integrated US Bank virtual card payment capabilities. This includes vendor management, purchasing, receiving, invoice processing, and payments via US Bank virtual commercial cards.

This collaboration is aimed at improving B2B payments by allowing AP departments to manage all payments from a single platform, which reportedly eliminates manual processing and helps reduce fraud. With US Bank’s virtual card solution, PaperTrl can deliver its customers a better payment experience, while also giving CFOs stronger visibility and control over spend, the company states.

#US Bank

Fintech Innovation Platform Launched by Valley Bank, Supported by NayaOne

Crowdfund Insider, Posted April 26, 2023

Valley National Bank, a principal subsidiary of Valley National Bancorp (NASDAQ: VLY), announced the launch of “a new innovation platform which will accelerate and enhance its collaboration with fintech companies to meet the needs of Valley’s customers in a rapidly evolving digital environment.”

Advancements in technology are “raising customer expectations for financial products and services, and with customers now having more options than ever to choose from, the cost of inaction has substantially increased for financial institutions.”

Understanding this environment, Valley’s innovation platform is “designed to embrace technological change, and enable the company to continue to transform its operations and deliver best-in-class customer experiences through partnerships with fintech companies.”

Powered by NayaOne, the platform is already “integrated with the products and services of hundreds of fintech companies through a simple and intuitive onboarding process.”

It also “provides a set of tools to create and apply synthetic data, allowing Valley and its fintech partners to test drive new solutions at pace within a safe, structured, and separate sandbox environment.”

#Valley National Bank

JPMorgan Creates AI Model to Analyze 25 Years of Fed Speeches

Bloomberg, Posted April 27, 2023

JPMorgan has built a ChatGPT-based language model to analyse Federal Reserve statements and speeches in an effort to sniff out potential trading signals.

The model scoured 25 years’ worth of Fed speeches to rank them on a “Hawk-Dove” score, says Bloomberg.

JPMorgan economists then plotted the index against asset performances and found that the AI could potentially help in predicting policy changes and be useful for trading.

In a note, the bank says “preliminary applications are encouraging,” and the model has already been expanded to cover the European Central Bank and the Bank of England, with more central banks to follow.

ChatGPT is widely seen as having a huge number of applications in financial services but firms, including JPMorgan, have been cautious about using it.

#JPMorgan

Visa staffs up for ‘ambitious’ crypto plans

Finextra, Posted April 26, 2023

Visa is on the hunt for senior software engineers for an “ambitious crypto product roadmap” that will “drive mainstream adoption of public blockchain networks and stablecoin payments”.

The payment giant’s head of crypto, Cuy Sheffield, posted about the job openings on Twitter, saying that he is particularly interested in people with experience using Github Copilot and other AI-assisted engineering tools to write and debug smart contracts.

A Web 3 Software Engineers job posting based in London says the crypto team is “building the next generation of products to facilitate commerce in everyone’s digital and mobile lives”.

Visa has been aggressively exploring crypto, blockchains and Web 3, despite the regulatory uncertainty surrounding the technologies.

#Visa

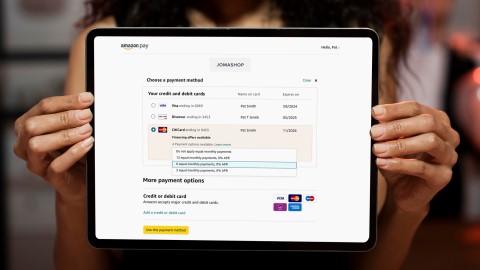

Amazon Pay rolls out Citi Flex Pay to give credit card users instalment option

Finextra, Posted April 27, 2023

Citi credit card holders can now pay in instalments when using Amazon Pay during checkout at thousands of online shopping sites.

The new payment option brings Citi’s Flex Pay BNPL option to a digital wallet for the first time.

Eligible Citi credit card members can select three to 48 month payment plans for purchases of $50 or more. Monthly payments are included in a cardmember’s minimum monthly payment due at the end of each billing period.

Amazon says that millions of customers have already used this payment option on its site but the new deal brings it to thousands of participating online retailers, including Jomashop, Litter-Robot by Whisker, and Fragrance.net.

Omar Soudodi, director, Amazon Pay, says: “Customers want flexible payment options and merchants want to offer that flexibility but don’t always have the resources to do so.

#Amazon Pay

LatAm

Belvo acquires Skilopay

The Paypers, Posted April 26, 2023

Belvo, an Open Finance data and payments platform, has acquired Skilopay, a Brazil-based payment institution specialising in payment services through Pix.

Belvo’s initial purchase will allow the business to extend its current payment product offering, which already includes Open Finance payment initiation, and become one of the most comprehensive account-to-account (A2A) payment providers in the Brazilian market. Belvo has already secured a Payment Transaction Initiator (ITP) licence to start processing payments under the Open Finance regulated framework of the Brazilian Central Bank.

Belvo now assists numerous Brazilian businesses in accepting payments via Open Finance payment initiation with enhanced conversion and security. This purchase now opens the door to a plethora of new payment use cases, which Belvo is actively developing and will integrate into its platform in the coming months. This includes options like Pix’s fast pay-in and pay-out capabilities, as well as storing cash in Belvo accounts where payments may be readily received and dispersed.

The company will remain committed to its purpose of assisting businesses in Latin America in leveraging Open Finance data and payments to produce more safe, efficient, and inclusive solutions.

#Payments

Shoplazza partners with Volt

The Paypers, Posted April 25, 2023

Shoplazza has partnered with Volt to enable its merchants to accept cross-border Open Banking payments in the EU, the UK, and Brazil.

Targeted at merchants in Hong Kong, Singapore, and China, the integration marks an important milestone for Shoplazza in its mission to help more product-focused ecommerce businesses reach lucrative non-domestic markets. Shoplazza hopes its integration of Volt will encourage more merchants to expand into Europe and beyond, with Open Banking technology providing a faster, safer, and more cost-effective means to reach new customers.

Shoplazza hopes its integration of Volt will encourage more merchants to expand into Europe and beyond, with Open Banking technology providing a faster, safer, and more cost-effective means to reach new customers.

#Fintech

InComm Payments creates 200 jobs with new Brazilian tech hub

Finextra, Posted April 26, 2023

America’s InComm Payments is set to create around 200 technology jobs in Brazil through the opening of an IT hub in the city of Fortaleza.

InComm Payments Brazil Technology will be a hub dedicated to developing payments options for industries including retail, financial services, mobile payments and more.

The 200 jobs created throughout the country will include software engineers, quality assurance automation, database administrators, DevOps, and database developers.

InComm, an Atlanta-based outfit that has been in existence for 30 years, has been operating in Brazil for more than a decade with operations in São Paulo and Porto Alegre.

Mark Holt, CIO, InComm Payments, says: “Our new hub seeks to further strengthen Brazil’s talent pool by creating opportunities for both students and seasoned professionals to enhance their skillsets and explore new possibilities for their careers.”

#Payments

FinanZero, a Credit Marketplace, Raises $1.5M to Support Expansion Efforts in Brazil

IBS Intelligence, Posted April 27, 2023

FinanZero, the online credit marketplace in Brazil, recently announced that it has raised USD 1.5 million in a funding round.

The proceeds from the investment round will be “used towards strengthening FinanZero’s position in the market through product development, specifically developing new online financing products for property and vehicle equity, and increasing marketing efforts.”

The investment “comes from a number of Swedish family offices, and follows the company’s USD 4 million round in 2022, which was led by VEF, Dunross & Co, Atlant Fonder and Webrock Ventures.”

Olle Widén, CEO and founder of FinanZero comments:

“We had such great interest in our previous round that we decided to extend this with an additional 1.5 million dollars this year on the same conditions and valuation as in 2022. It’s encouraging to see the continued support from our investors and this additional funding will help speed up our continued growth and product development.”

FinanZero has “seen 13 million customers register on its marketplace to date, with 1.2 billion in loan volume.”

#Fintech

Payment Orchestration Fintech IXOPAY Teams Up with LatAm’s EBANX

Crowdfund Insider, Posted April 26, 2023

IXOPAY, an independent payment orchestration provider, and EBANX, a Fintech company that specializes in international payments in rising markets, have announced a partnership.

Together the partners will “focus on providing access to local payment solutions for global brands and offering local payment methods to consumers, at first in the Latin America region.”

The partnership’s main goals are “to improve accessibility to new regions and enable growth for international merchants.”

IXOPAY’s agnostic payment orchestration platform “establishes the basis for flexible payment stacks and connects its clients to multiple payment providers and payment methods via a single API.”

By joining forces with EBANX, the partners will “extend the ability to accept local cards in Argentina, Brazil, Colombia, Chile, Mexico, and Uruguay.”

Central and South America are reportedly “the two fastest-growing regions of digital buyers worldwide and will continue to grow through 2025, with an annual growth rate 2.5 times that of North America,” according to the latest EBANX’s Beyond Borders study.

#Fintech

Thank You for reading us!

Finstar PR Department