Dear Colleagues!

Kindly find our weekly fintech and banking newsletter. If you do not want to receive it, you can unsubscribe from the mailing list at the bottom of the page.

Yours faithfully,

Finstar PR Department

Аsia

Philippines: Digital Banking Platform GoTyme Bank Partners with Mambu to Streamline Financial Services

Crowdfund Insider, Posted January 25, 2023

Newly launched Filipino digital bank GoTyme Bank has partnered with global cloud banking platform Mambu in order “to deliver an innovative digital banking solution that is aiming to improve access to high quality financial services for Filipinos.”

Singapore-based Tyme Group, which has partnered with Gokongwei Group “to launch GoTyme Bank in the Philippines, has had a long-standing relationship with Mambu.”

Nate Clarke, President and CEO of GoTyme Bank, said:

“With the knowledge gained from transitioning Tyme Bank in South Africa to a fully digital bank, we knew we needed GoTyme Bank to be ‘born in the cloud’ in order to have the capacity to scale efficiently, so Mambu’s SaaS cloud-native, API-first banking platform was the obvious choice for us. We understood what the Mambu platform was capable of and we were confident it would enable us to ‘lift and shift’ the TymeBank digital bank concept from South Africa to the Philippines, a market very similar in some ways, but very different in others, particularly in terms of the regulatory landscape.”

Nate Clarke, President and CEO of GoTyme Bank, said:

“We understood what the Mambu platform was capable of and we were confident it would enable us to ‘lift and shift’ the TymeBank digital bank concept from South Africa to the Philippines, a market very similar in some ways, but very different in others, particularly in terms of the regulatory landscape.”

As noted in the update, GoTyme Bank in the Philippines “offers next-level digital banking services via kiosks set up in retail outlets belonging to Robinsons Retail Holdings Inc under the Gokongwei Group.”

#Digital Bank

Indonesian POS startup bags $12m in Intudo-led series B round

Tech in Asia, Posted January 25, 2023

iSeller, a point-of-sale (POS) startup based in Indonesia, has raised US$12 million in a series B funding round led by Intudo Ventures, with participation from KVision, Mandiri Capital Indonesia, and Openspace Ventures.

With the deal, iSeller also completed its acquisition of local payment gateway Yukk. Founded by Jimmy Petrus in 2016, iSeller offers various services to help business owners manage sales and operations. They include POS systems, digital payments support, and inventory management, as well as integration with online marketplaces and food delivery platforms.

#Startup

Sequoia India, PayPal Ventures back Dubai-based BNPL firm’s $58m round

Tech in Asia, Posted January 25, 2023

Tabby, a buy now, pay later firm based in the United Arab Emirates (UAE), has raised US$58 million in a series C round from Sequoia Capital India, STV, and PayPal Ventures, among other investors.

The latest raise values Tabby at around US$660 million, making it one of the largest startups in the Middle East and North Africa region. The firm also becomes PayPal Ventures’ first investment in a startup based in a Gulf Cooperation Council market.

Founded in 2019 by Hosam Arab and Daniil Barkalov, Tabby has grown to amass over 3 million active users. In addition to BNPL, the startup also offers Tabby Card – a Visa-powered digital card that lets users split their in-store purchases in four installments without interest.

#BNPL

Europe

Here is the List of European Crowdfunding Platforms Approved Under ECSPR

Crowdfund Insider, Posted January 24, 2023

In November 2021, pan-European crowdfunding rules became actionable after approval by the European Union in 2020. Under the new rules, or European Crowdfunding Service Providers Regulation (ECSPR), a platform may raise up to €5 million from investors in all member states. This opens up investment crowdfunding to over 300 million EU citizens. The industry has heralded the new rules as a transformative event – a change in policy that took around 9 years of advocacy from industry insiders. At the same time, ECSPR is foundational to the concept of European monetary union – the ability for goods and capital to flow seamlessly across the EU.

Under the new rules, a securities crowdfunding provider must be approved by the “relevant authority” within the country where it is based. This has led to some discrepancies between regulators as some have moved quicker to craft a process for ECSPR approval while others have moved more slowly. The disparity between countries led the EU to delay full compliance until November 2023 (originally set for last November).

#Fintech

Corlytics acquires ING RegTech platform SparQ

IBS Intelligence, Posted January 25, 2023

Corlytics has acquired SparQ, a regulatory monitoring platform spun out of ING, in a €5 million aggregate deal.

Developed jointly by ING’s compliance and legal teams, the SparQ tool creates a single repository storing all decisions and assessments related to regulatory change.

Corlytics has partnered with ING on SparQ since 2018, providing regulatory information and risk data to 550 users across the bank.

ING’s chief compliance officer, Rein Graat, says: “Corlytics became a key partner in 2018 and it is fitting that, after the global roll-out internally, the next stage of SparQ’s journey will be with the company that can bring its development to the next maturity level of being an industry-wide leading platform.”

#RegTech

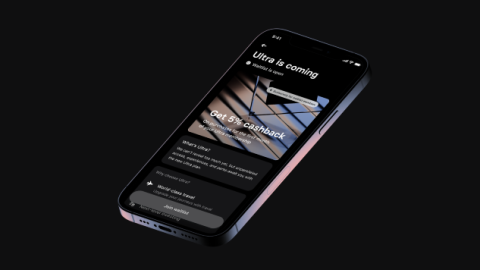

Revolut opens waitlist for new top-tier membership plan, Ultra

Altfi, Posted January 23, 2023

Revolut is to roll out out a new super-premium membership plan targeting ambitious, affluent individuals interested in a luxury lifestyle.

The new top-tier plan, Ultra, offers users free lounge access at 1200 airports, cashback, and low fees on Revolut investment products. Coming in the Spring, Revolut is inviting new and existing customers to join a waitlist to unlock 5% cashback on purchases made in their first month with Ultra.

The new membership level is coming in spring 2023. The current tiers, Plus, Premium and Metal are charged at £2.99, £6.99, and £12.99 per month respectively. Revolut has yet to reveal the price tag for Ultra.

Tara Massoudi, Revolut general manager of premium products, says: “More of our customers are interested in financial products offering better convenience. This growing consumer market is focussed on a new definition of luxury, one that is functional. Although these high-earning consumers are climbing the career ladder and want to build a steady passive income, they also aim to enjoy life, keep up to date with the latest trends and travel multiple times a year.”

#Fintech

ECB contemplates development of basic digital euro app

Finextra, Posted January 24, 2023

The European Central Bank is considering a new digital euro app, which would include basic payment functionalities and create a standardised approach to connecting end users to intermediaries.

Outlining the approach, ECB board member Fabio Panetta says the underlying objective behind making such an app available is to provide the market with the minimum required development, ensuring that intermediaries – including smaller ones who may not want to bear the investment costs of setting up their own payment interface – keep their roles in digital euro distribution.

At the same time, the app would respond to the preferences of certain end users who have called for an independent access channel in which basic functionalities are available, as expressed by consumer’s associations and market surveys.

#App

Germany: Robo-Advisor Ginman Looks to Expand into Digital Assets

Crowdfund Insider, Posted January 25, 2023

Ginman, a Germany-based Robo-advisor, is looking to expand into digital assets, according to a note from the firm. Ginman historically has focused on equities – more specifically, ETFs or exchange-traded funds.

As it seeks to add digital assets as an investment option, Ginman has added Markus Pertlwieser to its Advisory Board. Pertlwieser is described as an expert on Fintech as well as banking. As an advisor, he will support the management of Ginmon in significantly promoting the expansion of the digital asset manager’s business relationships with banks, fund providers, and insurance companies.

Lars Reiner, CEO and founder of Ginmon, commented on the new objective:

“We are very pleased that in Markus Pertlwieser we have been able to gain an experienced strategist with extensive know-how in digital business models as an advisor. Markus has an excellent network in the financial industry and has already initiated many successful partnerships between Fintechs, banks, and insurance companies. His experience will help us a lot on the way to our goal of making Ginmon’s technology platform the No. 1 for digital wealth management in Germany.”

Until the end of 2022, Pertlwieser was CEO of Penta, a neo-bank for SMEs and freelancers based in Berlin. Prior to Penta, he worked in various management positions for Deutsche Bank from 2008 to 2020, most recently as a member of the Management Board of the private and commercial bank and as Chief Digital Officer.

#Fintech

France: AMF Comments on Investment Crowdfunding – “An Investment of Conviction”

Crowdfund Insider, Posted January 25, 2023

The French Autorité des Marchés Financiers (AMF) has posted a comment on its website commenting on investment crowdfunding. The AMF notes to change to online capital formation under EU harmonized rules or European Crowdfunding Service Providers Regulation (ECSPR).

Crowdfunding: a regime undergoing transition

Crowdfunding, initially regulated at national level, has been the subject since November 10, 2021, of a harmonized European regime for the financing of projects of a commercial nature in the form of loans against payment or securities. Crowdfunding platforms subject to the national regime have until November 10, 2023, to take the necessary steps to be able to continue their activities beyond this date.

The AMF adds that “participatory financing” or crowdfunding is an alternative mode of financing to traditional players – like banks – for entrepreneurs and innovative firms who wish to finance a commercial activity. This includes early-stage firms, real estate investments, and more. The AMF has also posted a comment on real estate or property crowdfunding – a sector of online capital formation that has garnered a good amount of traction in France.

#Fintech

Commerzbank sues EY over €200 million Wirecard loss

Reuters, Posted January 19, 2023

Commerzbank is suing EY for the recovery of €200 million in losses from the collapse of disgraced German payments firm Wirecard.

Wirecard was a rising blue chip star before its implosion following the discovery of a gaping €1.9 billion hole in its balance sheet.

Wirecard had a credit facility of €200 million with Commerzbank, of which about 90% was drawn at the time of its undoing. ING, ABN Amro Bank and Landesbank Baden-Wuerttemberg all had a similar exposures.

As a court case against Wireccard executives proceeds in Munich, fingers have been pointed at EY, the accounting firm which for ten years approved Wirecard’s books, even as red flags about the company’s financial position were being raised by journalists.

#Fintech

UK Financial Services Firms Could Provide More Secure Services by Leveraging Phishing-Resistant Tech: Report

Crowdfund Insider, Posted January 25, 2023

The United Kingdom has consistently taken a strong position on cybersecurity, “recognizing the need to drive awareness and responsiveness on a national scale,” according to an update from Hypr, the passwordless service provider.

It reportedly “established the National Cybersecurity Centre in 2016, has among the strictest security and data protection laws, and recently launched its £2.6 billion National Cyber Strategy.”

The tough stance “holds even more true for banking and financial services organizations, with additional requirements imposed by the Bank of England’s Prudential Regulation Authority (PRA) and international bodies, such as PCI-DSS.”

While these regulations are positive steps, “it means compliance ends up driving many security decisions — to the potential detriment of organizations and their customers.”

In a recent Ernst & Young survey, CISOs in the UK “named ensuring compliance as the most stressful element for their role, yet only 36% believe that compliance requirements focus on the right aspects of security.”

#Fintech

USA

Klarna introduces Spotify-style ‘Money Story’ overview

Finextra, Posted January 25, 2023

Klarna has taken a leaf out of Spotify’s playbook with the launch of Money Story, a a personal summary of 2022 that provides consumers with useful insights into their spending habits

Money Story uses the animated ‘story’ format popularised by social media, to provide users with spending insights that they can convert into financial goals for 2023. The package visualises spending patterns and presents animated quiz questions that prompt users to reflect on where they think they spent their money in 2022.

Next to their total spending for 2022, consumers also receive insights segmented by month, retailer and category. Each user’s Money Story also includes nudges to discover and test Klarna’s money management tools, such as the budget tracker and the monthly spending breakdown.

#Klarna

Ex-Plaid product lead launches e-commerce payment processing platform

Finextra, Posted January 25, 2023

Wafi, a startup founded by former Plaid product lead Victor Umunze, has launched its payment processing platform for e-commerce businesses.

Wafi.cash promises to provide online sellers with a simple API to enable fast, secure, and cost-effective processing of bank payments.

The platform is designed to eliminate redundant entities in the payment processing flow, reducing payment processing fees by over 50%, says Wafi, while helping users earn up to 0.75% cashback on purchases.

Wafi also helps reduce payment failures and cuts fraud thanks to its 2FA and propriety detection technology.

#Startup

PayPal Ventures Invests in MENA Region Fintech Tabby’s $58M Series C

Crowdfund Insider, Posted January 25, 2023

Tabby, one of MENA’s shopping and financial services apps, has raised $58 million from Sequoia Capital India, STV, PayPal Ventures, Mubadala Investment Capital, Arbor Ventures and Endeavor Catalyst in a Series C round which values the company at $660 million.

The fundraise will be used “to expand Tabby’s product line into next-gen consumer financial services and support the company’s growing operations.” This investment round makes Tabby one of “the most valuable startups in MENA and the first in the GCC to receive funding from PayPal Ventures.”

Hosam Arab, CEO and Co-Founder of Tabby, said:

“With rising interest rates and growing inflation, it has never been more important for people to have access to payment flexibility to stay in control of their finances. Despite downward pressure on fintech valuations, our business continues to sustainably scale as we lead the generational shift towards fair and transparent financial products in MENA.”

He added:

“We’re excited to grow with an incredible set of investors who believe in the opportunity to create a healthier relationship with money for consumers in a region that’s ripe for change.”

The company works “with over 10,000 brands including 9 out of the 10 largest retail groups in MENA, and more recently launched with noon, the region’s largest ecommerce marketplace.”

#PayPal

Stripe scores major Amazon deal

Insider Intelligence, Posted January 25, 2023

Stripe has become a strategic payments partner for Amazon in the US, Europe, and Canada, processing a “significant” portion of the tech giant’s total payments volume across its businesses, including Prime, Audible, Kindle, Amazon Pay, Buy With Prime, and more.

The global agreement builds on a partnership that began in 2017, when Amazon began using the payments firm to accelerate market expansion in Asia and Europe.

Max Bardon, VP, payments, Amazon, says: “In particular, we value Stripe’s reliability. Even during peak days like Prime Day, Black Friday, and Cyber Monday, Stripe delivers industry-leading uptime. We appreciate Stripe’s relentless commitment to putting users first.”

The deal also sees Stripe expand its use of Amazon Web Services as its cloud infrastructure provider. Stripe will use AWS’s Graviton for efficiency and performance in data processing, and Nitro enclaves to enhance data security.

#Amazon

Big US banks prep mobile wallet to take on Apple

CNBC, Posted January 23, 2023

America’s biggest banks are teaming up to take on Apple and PayPal with a digital wallet linked to customers’ debit and credit cards, according to the Wall Street Journal.

Wells Fargo, JPMorgan Chase and Bank of America are among the seven lenders backing the wallet, which will be run by Early Warning Services, the bank-owned venture behind P2P payments service Zelle, says the Journal.

With Visa and Mastercard onboard, the wallet will launch with 150 million debit and credit cards available for use when it arrives in the second half of the year.

The move is designed to help banks take on third-party players such as PayPal and Apple, says the WSJ, citing sources. The latter has been making a push into the banking sector through its wallet, credit card and plans for a BNPL product.

#Apple

Sanctions screening fintech GSS raises $45 million

Finextra, Posted January 23, 2023

Sanctions screening startup GSS has raised $45 million in its initial funding round.

Investors included AlixPartners, The Cynosure Group, and MUFG. Randal Quarles, chairman and co-founder of The Cynosure Group, and former vice chairman of the Federal Reserve System and chairman of the Financial Stability Board, has joined the GSS board. William Langford, global head of financial crimes compliance and chief compliance officer for the Americas at MUFG, will serve as an observer to the GSS Board.

Incubated by AlixPartners since 2021, GSS has created a centralised, cloud-based platform for banks and financial institutions to conduct and share payments screening data, removing the duplication of effort across compliance teams and reducing friction and delay in international payments.

#Startup

LatAm

Half of Young Brazilians Ready to Go into Debt to Invest in their Own Business, Survey Reveals

Crowdfund Insider, Posted January 25, 2023

Young Brazilians already “demonstrate mastery of basic concepts of financial education and how to spend money thinking about the future,” according to an update shared by C6 Bank.

The most recent survey by C6 Bank/Datafolha indicated, for example, “that 50% of boys and girls aged 12 to 17 would use the money from a loan to undertake.”

Another 42% would “go into debt to pay for a course abroad, while less than 15% would agree to take on debt to buy computers or cell phones, to give themselves a gift or to undergo a cosmetic treatment.”

Datafolha interviewed 942 teenagers and young people “between the ages of 12 and 17, from all social classes and regions of the country, between October 18th and 25th.” The poll’s margin of error “is two percentage points.”

#Fintech

Open Finance: Nubank Allows Clients to Access Balance from Other Institutions via App

Crowdfund Insider, Posted January 25, 2023

Nubank has launched a new functionality that allows customers to view, within the Nu application, the balance of all their bank accounts linked to Open Finance.

The tool is still “in the testing phase, and will initially be offered to 300,000 customers that are part of NuCommunity.” It will be gradually “released to the entire user base of the institution in this first quarter.”

Throughout its trajectory, Nubank has “created products and services that offer real solutions for users.” Therefore, in September 2022, it “anticipated and integrated Open Finance even before it became mandatory for the company.”

The new balance aggregation functionality, “offered shortly after the integration of Nubank to Open Finance, is the result of the company’s ongoing work to democratize access to efficient financial products that, above all, restore control of customers’ financial lives.”

#Fintech

Thank You for reading us!

Finstar PR Department